In a world of fast-moving information, especially in the world of international trade, it is difficult to keep up with all the news.

That’s why DocShipper has put together a selection of current news summaries on different types of freight, supply chain innovations and world news so that you don’t miss any more.

Trade Routes from Shanghai

Figure of the week: 115 billion USD

The combined operating profit (EBIT) of the world’s top ten container shipping lines in 2021, according to the latest calculations by Alphaliner.

More and more voices are being raised about the post-Shanghai containment, with the blocking of the Yantian terminal in Shenzhen in spring 2021 as a benchmark. A year ago, Yantian saw its business contract by 30% for a month, but the side effects were massive across the supply chain. Many are therefore predicting an even more violent backlash this time, as all of Shanghai, home to the world’s largest port, is on pause.

There is still no visibility in Shanghai, which is confined and where truck movements are barely 15% of their usual level. The authorities have announced measures to revive industries, but the rules are draconian. However, Tesla and SAIC factories could resume production this week.

As a result, a spike in blank sailings is feared in Shanghai. Alan Murphy

(Sea-Intelligence) reminds us that shipping companies have not yet chosen this option, but if the lockdown lasts, and “if factory closures persist, it is highly likely that the number of blank sailings will start to increase in the coming weeks”, estimated the maritime expert.

Cargo operations at Shanghai Pudong Airport are still limited and no one expects any improvement for at least three weeks. Trucking service, heavily impacted by the measures, is running at a slow pace, with high rates and delays of up to five days.

04/20/22

Hapag-Lloyd stops their MPS services due to ports overcrowding

The Mediterranean Pacific Service (MPS), on which ZIM charters spaces, will be discontinued by Hapag-Lloyd ; so far it was serving between the Mediterranean and the US West Coast. Fos sur-Mer is served by this service.

11/04/2022

Russian containers, a stumbling block for Rotterdam’s port

The congestion in Rotterdam’s port has a Russian flavor to it. Since the beginning of the Ukrainian conflict, the main entry point for products into Europe has had to deal with thousands of containers bound for Russia. Controls must be accurate to identify and isolate boxes that could be sanctioned, and for good reason. The port management described the situation as a “horror.” On the quay, about 4,500 containers are awaiting inspection, taking up valuable space.

Nearly ten percent of all containers passing through Rotterdam are connected to Russia in some form.

The transatlantic route is clogged with traffic.

Congestion at several major U.S. East Coast ports, which have been in high demand since 2021, has reduced the reliability rate of east-west schedules down to just over 10%, according to Sea-Intelligence. This is in addition to the problem of Russian containers in Europe. Observers predict that progress will be slow. Many layovers have been eliminated.

06/04/2022

Shanghai Pudong remains inaccessible.

The situation at Pudong Airport remains serious due to Shanghai’s prolonged closure (PVG). Strict sanitary regulations limit pick-ups and force the closure of handling stores, effectively rendering the airport cargo-inaccessible. Almost all major airlines have canceled flights as a result of the storm.

Experts projected that clearing the backlog and returning to normal operations once the lockdown was lifted would take nearly two weeks, but that was before the extension was announced.

What OVRSEA (and, by the way, DocShipper) recommends:

For small lots, Beijing (PEK) or Kunshan are good options to PVG, as are Zhengzhou and Hangzhou for larger lots. Rates are rising upwards due to a logical increase in demand from these destinations.

The situation has now returned to normal in other parts of China, particularly in Shenzhen and Guangzhou. Demand is returning to Hong Kong, and with it, rates are rising.

06/04/2022

New variant, Shanghai remains in quarantine

The decontamination of Shanghai and its 26 million residents, which had been scheduled for this week, has been postponed, as expected. Nearly 13,000 cases of Covid-19 were found on Monday, prompting the start of universal screening. Worryingly, a new sub-variant was discovered in Suzhou, 80 kilometers away, this weekend.

Factory and trucking operations are severely impacted, while container ports remain operating in theory, thanks to the installation of “closed loops.” However, in practice, activity is significantly reduced.

The terminals at Waigaoqiao and Yangshan appear to be the busiest. Flows from Shanghai are frequently redirected to Ningbo.

The “stability of the manufacturing supply chain” was harmed, according to China’s National Bureau of Statistics.

What about shipping costs?

Globally, the decreasing trend continues. It is most noticeable in relation to the United States. Drewry’s World Container Index is down 8% (to US$9,112) on the Shanghai-Los Angeles route, and down nearly 13% from Hong Kong.

06/04/2022

Shanghai under quarantine : another disaster for China

Covid pandemic is still going on, in China. Even tho authorities are looking to keep the chinese impact in the international shipping, it is going to be tricky. Shanghai is under a two-step quarantine : Pudong and its areas at the Huangpu river’s east between March 28 and April 1st, then the river’s west for five days, starting this Friday.

Reminder on the 29 March’s situation :

- Shanghai’s port is alright, but inner-transports, warehouses and a few manufacture sites slowed down.

- Trucking services to Shanghai reduced by 30% (Maersk)

- Flux are getting redirected, to Ningbo, for instance

- Shipping delays and transports getting higher

- Confinement might last beyond 5th April depending on the crisis evolution

- The biggest chinese ports are being cluttered as it hasn’t been for about 5 months.

Now what about the aerial situation in Shanghai Pudong ?

The quarantine announcement in Shanghai has for sure had an instant impact in Pudong airport (PVG). Officialy, its activity isn’t any affected, but in reality, not to keep some almost-empty flight, they’re canceling those, as is Cargolux and China Airlines. Furthermore, the duty processes are slowed. For now, the best alternative to this toiling PVG is Zhengzhou airport.

A few good news though : the situation is getting better in Shenzhen and Guangzhou as well as in Hong Kong. For now, the Shenzhen border is getting back to normal, even though a bunch of flights are being canceled. It is getting better, we just have to be patient.

Sea shipping : Rates keep lowering on the long trades

It’s undeniable, indexes emphasize their fall, on most of the sea way. The Drewry’s World Container Index (WCI) backflowed by a -4,1% by last week’s end. Actually it even reaches a -8% on the Shanghai-Rotterdam trade, when the index melted by a 3000 USD compared to the Chinese New Year’s rates.

Furthermore, we can note a -3% on the Shanghai-Gênes (12 201 USD/FEU), also a -2% on Shanghai-Los Angeles (9 926 USD/FEU). Though, indexes are getting a 5% growth on transatlantic trades, as is Rotterdam-New-York (6793 USD/FEU)

Are we looking at the market turning point ? Not so sure. And it has reasons, this gentle fall isn’t even close to the one post-CNY one on the 6 years pre-Covid (-29% while “only” -20% in 2022).

30/03/2022

Covid: a mixed bag in China, plus increased port pressure

Covid-19’s expansion in China, a new hub in the global supply chain, is being closely monitored. Here’s the latest news on that front as of March 22:

The Shenzhen lockout has been lifted and production has resumed at Foxconn Technology. The seven-day lockout, however, limited local transit and storage options.

The port of Yantian has seen a 43 percent drop in loading volumes since early March. (FourKites). Vessel waiting times have lengthened and Maersk said it would skip a number of ports between Yantian and Shekou this week.

Port demand is increasing in Qingdao, Shanghai and Ningbo-Zhoushan, creating a significant risk of port congestion.

Hapag-Lloyd will temporarily stop service to Hong Kong in its EC1 (East Coast Loop 1) cycle and to Qingdao in its EC2 cycle from April 8 and 9.

Shenyang, the industrial center of Liaoning province with a population of 9 million, was confined on Monday.

23/03/2022

Maritime: Transatlantic trade is expected to experience difficulties in the second quarter

Shipping between Europe and North America could be disrupted throughout the summer for a variety of reasons.

The International Longshore and Warehouse Union (ILWU) is ready to negotiate new contracts with West Coast ports and port owners, and for good reason. This is the first round of negotiations since 2014, and it is expected to be a difficult one, with the possibility of a major strike. As a result, trade from Asia could be diverted to the already overcrowded East Coast ports.

At the same time, current operating conditions for Europe-North America traffic are not ideal. In the face of unabated demand, supply is weaker, more unpredictable and also poorly organized. Bookings take 4-5 weeks. It is safe to assume that fares will increase in the second quarter.

23/03/2022

Shenzhen airport is congested

The reappearance of Covid in Chinese airports has varying consequences depending on the location. The cargo that has been piling up for a week in Shenzhen and Dongguan is creating traffic jams. Health regulations in Fujian province and around Beijing are making air shipments very difficult to manage.

Despite the increase in Covid-19 cases, Shanghai officials are more accommodating. However, keep in mind that Apple has “chartered” a very large number of planes, which reduces the available capacity. Fares are up again.

The good news comes from Hong Kong, where the government has agreed to finally relax the laws. Although access to the land border to and from Shenzhen remains difficult, cargo supplies should resume. For example, cargo planes are now used to cross the 95 kilometers…

What are the repercussions of Monday’s accident? Following the fatal accident involving 132 people, China Eastern Airlines has suspended its entire Boeing 737-800 fleet until further notice. It cancelled more than 1,900 domestic flights on Tuesday.

23/03/2022

Saudi Arabia mulls accepting yuan instead of dollar for Chinese oil sales

According to people familiar with the situation, Saudi Arabia is in talks with Beijing to price some of its oil exports in yuan, which would weaken the dollar’s hold on the global oil market and mark a further shift in the world’s largest crude exporter’s focus to Asia.

Sources say the Saudis are increasingly unhappy with the security guarantees the United States has offered for decades to protect the country. Negotiations with China on oil contracts at the price of the yuan have been on and off for the past six years, but have accelerated this year as the Saudis have grown increasingly unhappy with the security guarantees the U.S. has offered for decades to protect the country.

18/03/2022

Shenzhen confined: ports open but warehouses closed

The port city of Shenzhen in southern China has imposed a seven-day lockdown due to Covid-19, which is disrupting land-based activities, while ports remain open. Routine utilities and supplies have been available since March 14, but urban transport has been suspended.

Last year, a Covid outbreak at the Port of Yantian sent shockwaves through the supply chain, shutting down about two-thirds of the port’s capacity for three weeks. Both Chiwan Container Terminal and Dachan Bay Terminal confirmed stable port operations in the current situation. Maersk and OOCL shipping companies have informed their customers that all three ports are operational.

However, inland logistics may be delayed. Several local logistics parks and warehouses have announced that their outbound and inbound cargo activities have been interrupted and are being closely monitored. Maersk’s Shenzhen warehouses were closed from March 14 to 20.

China’s strict “zero Covid” policy is being tested by the rapid emergence of the Omicron variant.

17/03/2022

Russia’s maritime access is diminishing

Sanctions are pushing cargo companies to flee Russian ports one by one, even though Ukrainian ports have been inaccessible from the commencement of the Russian invasion.

On Tuesday, Maersk announced the suspension of all calls in Russia, with the exception of food, medical supplies, and humanitarian aid. The gang said that they would obey orders until the punishments were disclosed. Ocean Network Express has also canceled bookings to Novorossiysk and St. Petersburg (ONE).

On Friday, Hapag-Lloyd was the first to refuse Russian bookings, followed by MSC on Monday.

CMA CGM has declared that cargo intended for Ukraine would be redirected to the ports of Constanza (Romania), Tripoli (Lebanon), or Piraeus (Greece) for the time being (Greece).

07/03/2022

Russia-Ukraine: transport tariffs are likely to explode

The supply chain is still reeling from the sanitary problem, and now there’s a war to add to the mix, which may not improve matters.

As a consequence of the invasion, air and sea freight charges are anticipated to surge once again.

Ocean freight charges might quadruple from $10,000 to $30,000 each container, according to FourKites CEO Glenn Koepke. He warns the New York Times that it may be much worse for air freight.

According to Glenn Koepke, sea freight prices have already hit record highs in the aftermath of the epidemic, and this battle might strike a significant damage to the global supply system. “Businesses are gearing up for the summer rush, which will have a significant influence on our supply chain.”

As a result of the invasion, numerous ships have been forced to modify their routes, with the most crucial one being the one in Ukraine, which closed on Thursday. On Monday, some 200 ships waited to traverse the Kerch Strait, which connects the Black Sea and the Sea of Azov.

Russian airspace is restricted to 36 nations in terms of aviation freight. As a consequence, flights will have to find new, longer routes, which will need more fuel, more money, and hence a rise in pricing.

04/03/2022

Ukraine-Russia conflict: impact on air traffic in Asia

The closing of Russian airspace to 38 Western nations has had a significant effect on aviation travel between Europe and Asia.

North Asia, particularly Shanghai, Japan, and South Korea, has been particularly hard hit.

Airlines such as Air France, Air Bridge, Polar Air, Cargolux, Lufthansa, KLM, Aeroflot, Finnair, and Virgin Atlantic have abruptly canceled a number of routes. They’re looking at changing their flight itinerary to fly via the south. In both directions (Europe Asia / Asia Europe), we find the same pattern.

According to some experts, around 14% of freight between these two locations will be impacted. The hike in charges is due to the restriction of the airspace above Russia.

For the time being, the best approach is to have a departure airport in the south of China, or utilize firms that are permitted to fly across the nation.

For the time being, there is no major interruption for passengers travelling between North America and China.

03/03/2022

Rail freight affected by the Russia-Ukraine conflict

Of all the freight modes, the one most affected by this conflict is rail freight.

The main entry point to Europe from China is Belarus, an ally of Russia, the New Silk Road (Ukrainian network) would be destroyed.

On Tuesday it was quite confusing, it was still possible to go through Belarus because the sanctions do not seem to affect the transit of products on Russian soil.

However, the Russian railroad line is included in the companies sanctioned by the United States and Europe. Also, the sanctions against banks would potentially make it impossible to use Russian infrastructure.

For the moment, the sanctions against Belarus only affect exports. It could be very complicated for the New Silk Road, which is very popular with the Chinese authorities. Today, many forwarders and shippers decide to abandon the rail.

02/03/2022

Russia-Ukraine conflict : trouble in the world shipping

Disruptions in transit, call cancels, and seaport closures, supply chain disruptions, declining demand, and escalating charter costs… The first operational and financial interruptions in the liner and tramp markets have occurred as a result of the crisis between Russia and Ukraine that erupted in the early hours of February 24.

It should be noted that Russia rapidly blocked Ukrainian ports (Odessa, Pivdennyi, Mylolaiv, and Chornomorsk), as well as the country’s airports. Only the business activity of Novorossiysk, a Black Sea port, is maintained on the invader’s land. However, it has ordered the closure of all facilities in the Azov Sea (Yeisk, Temryuk, Rostov-on-Don, Taganrog and Ust-Donetsky). All of these ports are located in the country’s south and specialize in liquid and dry bulk cargo (oil, grain, coal, etc.).

The West’s sanctions on Russia (the European Union, the United States, and the United Kingdom) risk exacerbating the chaos that the war has already created on the commodity markets. Russia contributes for 3.7 percent of world commerce in dry bulk (coal, fertilizer, and grain), 5.7 percent in liquid bulk (crude oil and processed products), and no less than 6 percent in LNG, according to a report by the British business Vessels Value.

Employers (ship owners, ship management businesses, and crew placement agencies) should find it difficult to pay seafarers of Russian or Ukrainian nationality due to the conflict and sanctions. According to the International Chamber of Shipping, seafarers from both countries that make up 14.5 percent of the world’s merchant marine workforce (ICS).

01/03/2022

The global impact of the Russia-Ukraine conflict on the supply chain

The key consequences on supply chains are described by Kristian Hong, a partner at strategic operations consulting Kearney.

Few Russian or Ukrainian Tier 1 suppliers are included in U.S. and European supply chains; however, the dangers increase when relationships with Tier 2 and Tier 3 suppliers are examined, and even more so when raw materials and energy sources are considered.

After Saudi Arabia, Russia is the world’s second largest oil exporter, producing more than 5 million barrels of petroleum per day, over half of which is shipped to European countries. Russia also provides more than a third of the natural gas consumed in the European Union. According to some estimates, a Russian invasion might push oil prices to $150 per barrel, slow global economy by about 1%, and double inflation. Furthermore, Russia holds around 10% of the world’s copper deposits and is a major producer of aluminum, nickel, platinum, and other precious metals needed in the manufacture of computers, cellphones, and other electronic devices…

Ukraine is a major exporter of corn, barley, and rye, whereas Russia is the world’s largest wheat exporter. With fresh price shocks arising from growing energy costs, agricultural land seizures, and extreme economic sanctions proposed by Western governments, food inflation will escalate quickly.

28/02/2022

The impact of the Russia-Ukraine conflict on maritime transport

Tanker transport and dry bulk would be the most affected sectors by this crisis.

Since Wednesday, many countries have imposed sanctions. Two Russian state banks have been sanctioned by the United States, the European Union, the United Kingdom, and Japan. VTB, Russia’s second largest lender, was also sanctioned by the US and the UK on Thursday.

“Any sanctions would target Russia’s oil and gas exports, which are the lifeblood of the Russian economy, accounting for around 40% of Russia’s income,” broker BRS warned Monday.

“Many Russian state-owned companies, such as Gazprom, Rosneft, and Novatek, are on the sectoral sanctions identification list but not the SDN list.

We could see the transportation exemption abolished, allowing OFAC [Office of Foreign Assets Control] or other regulators to declare that moving oil extracted in the Russian Federation is a sanctionable activity, which would be a major changer for the shipping business.”

Sanctions like this, which currently target Iranian and Venezuelan oil carriers, can have far-reaching and unforeseen market implications.

Military action in the Black Sea, a vital transit location for dry bulk exports, might hinder ship movements.

The impact of Russian ship movements on traffic is undeniable.

The Black Sea and the Sea of Azov have been recognized as “listed regions,” which entails increased war risk insurance rates for Russia and Ukraine.

The container shipping business may appear to be less affected by the Russia-Ukraine conflict than tanker and dry bulk shipping. However, Lars Jensen, CEO of consultancy firm Vespucci Maritime, sees a significant risk that might prolong congestion and maintain historically high freight rates in place.

Russia will also launch cyberattacks, which would inevitably disrupt ports and shipping lines. Despite the fact that their cyber security has improved dramatically in the last five years, if an attack succeeds and we lose a single major port for two or three days, the supply chain will be severely disrupted globally.

25/02/2022

The impact of the Russia-Ukraine conflict on logistics

Thousands of kilometers away, this conflict will have significant economic effects. To begin with, there has been a significant increase in the price of gasoline, which has been continuously increasing for several weeks.

Germany has declared the suspension of the controversial Nord Stream 2 gas project, which connects Russia to Europe and transports Russian gas.

Because Russia supplies 40% of the gas utilized in the EU, the price of gas is a major problem.

Russia could decide to stop sending gas to Europe or restrict export amounts, causing prices to skyrocket.

Oil prices have increased by 3% and have surpassed the $100 level for the first time since 2014.

These increases will have an immediate and medium-term impact on the price of logistics, which will see a rise in the cost of its raw materials, which are critical in this sector.

24/02/2022

Marine fuel prices on the rise

Very bad news for ship operators and container customers.

This increase is due to the price of gas and the change in fuel for LNG carriers.

According to Ship & Bunker, the average price of VLSFO would be about $731.50/ton in the top 20 bunkering ports.

18/02/2022

The impact of the pandemic on oil tankers

In 2021, tanker operators suffered their worst year since the 1990s, and 2022 is off to a horrible start.

Because the industry’s recovery is taking longer than expected, predictions for crude oil transportation demand are being revised downward.

Following the Omicron version, the market for black gold supply has been disturbed due to a significant increase in natural gas prices as well as geopolitical concerns.

The market entered a contango phase, which occurs when oil has lost all value. As a result, supertanker charter rates have risen considerably.

The end of the crisis is approaching, according to Hugo de Stoop, CEO of Belgian shipowner Euronav, and we will be back to business as normal with a good supply/demand balance.

Despite global petroleum stocks being at their lowest level in six years, he predicts that output will rise to 2019 levels (about 100 Mb/d).

The price of oil has risen dramatically. With rising geopolitical tensions and natural gas demand in Europe and Asia in recent days.

The price of a barrel of oil is currently $90, according to one shipping broker, the highest it has been since late 2014. If current price increases continue, demand will be destroyed and prices would plummet.

Natural gas prices might reach $200 to $250 per barrel if war breaks out between Russia and Ukraine, according to Seb, an Oslo-based commodity expert.

14/02/2022

The project of two forwarding agents

The British Inivers and the Italian RifLine are two forwarding agencies who have recently established their own shipping business and line, one between Tilbury and Taicang, Ningbo and Dachan Bay, and the other between Salerno and Civitavecchia to two Chinese ports.

Ellerman City is the name of the British forwarder, while Kalypso Compagnia di Navigazione is the name of the Italian forwarder.

To avoid congestion at key hubs, their services make calls to secondary ports.

The introduction of the Italian firm, which is still relatively new, took place on December 29th. It intends to open a second route between Italy and Bangladesh, but this would need the acquisition of a ship, which is now exceedingly difficult.

10/02/2022

Terminals of three major ports targeted by a cyber attack

In addition to the tight situation between the EU and the US, with Russia threatening the flow of gas and oil, the public prosecutor’s offices in Antwerp and Hamburg have launched an inquiry into a cyber-attack. German, Dutch, Belgian, and maybe other nations’ port infrastructure have been attacked.

We don’t know much about these assaults, which targeted three major ports in Northern Europe, at the moment (Antwerp, Rotterdam, and Hamburg).

On January 29, the first activities took place. Indeed, according to the German oil storage corporation Marquard & Bahls, an event occurred on January 29 after two emergency plans in their companies Oiltanking and Mabanaft. The flow of oil via land was hampered as a result of these occurrences.

At least six oil facilities in Belgium and the Netherlands were attacked in one day, according to the Belgian daily De Morgen. The Sea-invest group’s companies in Gand were also targeted, causing the inland port’s operations to be hampered.

According to Handelsblatt, the assault is the result of Russian-language malware dubbed BlackCat.

08/02/2022

Sea freight threatened by the Omicron variant ?

While China’s main port, Ningbo, sits idle, the Omicron version poses a threat to trade. However, this is not all bad news for shipowners, who had a banner year in 2021.

Sea freight has expanded by leaps and bounds since the global pandemic. As per Drewery, shipping companies will earn $150 billion in income in 2021, a $150 billion increase over the previous decade. However, the Omicron version threatens the start of 2022.

China, that has a “zero Covid” strategy, does not shy to quarantine towns and cities as soon as the first instances are discovered. Chinese officials have briefly blocked their main port, Ningbo, near Shanghai, in recent months. It has been harmed again in recent days, resulting in failures.

05/01/22

End of the referencing of the Wish website in France

French Internet users’ search engine searches will no longer be sent to this American online sales site. The General Directorate of Competition, Consumption, and Fraud Control highlights noncompliance and, in some cases, risk in some offered items. Wish, a major player in e-commerce and, in particular, DropShipping, decided to counter-attack.

Enough is enough for the French government. Wish, the American online seller that has rejected the French government’s orders to withdraw some non-compliant or harmful items for several months, must be sanctioned. And now the knife has dropped. The General Directorate for Competition, Consumer Affairs, and Fraud Control (DGCCRF) has recently ordered search engines to defer the site, revealed Economy Minister Bruno Le Maire in “Le Parisien” on Wednesday. In Europe, this is an exceptional choice.

In practice, this means that French Internet users who search for a product on Google or Microsoft’s search engines will no longer be shown with the Wish site’s offerings. This does not imply that Wish is totally off the French Internet. Followers of the platform will still be able to shop there, but they will have to input the website’s address manually.

12/03/21

COSCO completes the purchase of Tianjin Container Terminal.

COSCO SHIPPING Ports (Tianjin) and China Shipping Terminal Development Co. (CSTD) finalized the Tianjin Container Terminal (TCT) partnership deal and terms of organization on November 24, 2021, with Tianjin Port Holdings Co. and China Merchants International Terminals (Tianjin).

TCT will execute the company registration processes for the JV agreement and articles as soon as feasible in order to accomplish all purchase requirements precedent, with the purchase and disposal planned to be completed concurrently in the coming years.

COSCO SHIPPING Ports (Tianjin) and CSTD, which is also a subsidiary of COSCO, will hold 45 percent and 6 percent of the equity stakes in TCT, correspondingly, for a total of 51 percent.

11/30/21

The first all-electric and soon-to-be self-driving container ship has been launched.

After repeated postponements, the long-awaited Yara Birkeland has finally debuted and is conducting its two-year trial phase. The 120 TEU feeder, which will be fully electric and autonomous eventually, is designed to transfer goods from the world’s top fertilizer maker Yara’s Porsgrunn factory in southern Norway to the seaport of Brevik, which is about 15 kilometers away.

The world’s first “totally emission-free and independent cargo vessel” left Horten, 56 kilometers from Oslo, on November 18 in the company of Norwegian Prime Minister Jonas Gahr Stre and his Minister for Maritime Affairs (Fisheries and Ocean Policy). On November 19, it sailed across the Oslo Fjord to arrive at the Norwegian capital.

“It will save 1,000 tons of CO2 and replace 40,000 diesel truck trips each year,” said Svein Tore Holsether, Yara’s managing director, who was receiving his illustrious visitors.

11/24/21

CMA CGM earns a whopping $5.6 billion in profitability.

According to the current report, CMA CGM Group recorded an amazing increase in earnings during the third quarter of the year, earning US$5.6 billion, compared to US$567 million the previous year.

The world’s third-largest cargo transporter reported even more impressive improvements in the fourth quarter, with profits before depreciation, interests, amortisation (EBITDA), and tax, standing at US$7.1 billion, representing a year-on-year increase of about 318 percent.

Simultaneously, the French Firm’s EBITDA margin was 46.4 percent, a 25.4 point rise over the third quarter of 2020, while consolidated revenue reached US$15.3 billion, a considerable gain of more than 89 percent, mostly due to the Group’s transport of goods.

11/23/21

Maersk and Vestas sign mega container cargo deal

As indicated by the understanding among Vestas and Maersk, the first gets immediate admittance to holder limit at a proper cost. This would somehow or another be difficult to get in the current climate and consequently, it will assist with guaranteeing business progression and cost consistency, as indicated by the declaration.

The organization, which will be successful from 1 January 2022, incorporates house to house transport from the Vestas’ providers to their processing plants and administration stockrooms, just as containerised site parts and transport hardware.

The organization involves a chance to co-foster a joint manageability venture, where the two firms can combine efforts to decarbonize coordination, as per an assertion.

11/10/21

CMA CGM and ENGIE to accelerate energy transition in the shipping industry

CMA CGM Group and the energy organization ENGIE have set up a drawn out key and modern association to continue with the energy progress in the transportation business by speeding up the modern scale creation and conveyance of engineered methane and melted biomethane (BioLNG).

The two accomplices are additionally putting resources into innovative work (R&D) with their modern partners to observe the energy wellsprings of things to come to empower the decarbonisation of the delivery area. What’s more, the organization covers the investigation of future guidelines, just as endeavors to bring issues to light of the advantages of BioLNG and manufactured methane as a marine fuel.

The CMA CGM Group and ENGIE have been cooperating for a very long time as a component of the Coalition for the energy of things to come dispatched in late 2019 at the Assises de l’économie de la Mer meeting by Rodolphe Saadé and upheld by French President Emmanuel Macron.

11/10/21

Port congestion: on the way to easing?

Just the coming months will permit us to quantify the drawn out consequences for the worldwide economy of the incredible disruption in supply chains that has denoted the year 2021, while some are as of now discussing stagflation. The exit from the wreck is as yet indistinct, yet there are a few markers that the issues are facilitating. For sure, it was sufficient for discretion to disrupt the general flow among Canberra and Beijing, as ahead of schedule as the fall of 2020, for wares to fold.

For VesselsValue, the wonderful clog in the compartment area has a guilty party: the Suez Canal, whose drawn out barricade by Ever Given “had repercussions well into the second quarter of 2021.

Different examiners contend that request might ease, in some measure for a brief time, as it is currently past the point where it is possible to import merchandise on schedule for the Christmas season. The pinnacle of the great season seems to have passed.

11/09/21

OOCL warns of fraudulent activities

Orient Overseas Container Line (OOCL) has reported that it as of late noticed an expansion in deceitful exercises and has cautioned that fraudsters can hack email accounts, and by all potential means cheat casualties to make settlements.

The email has all the earmarks of being sent from OOCL representatives anyway they are sent by unapproved staff from different dubious email addresses.

In the interim, in the course of recent months, cybercrime knowledge organization Intel 471 has noticed organization access dealers offering qualifications or different types of admittance to transportation and coordination’s organizations on the cybercrime underground.

At the point when this area is battling to keep things working, a fruitful assault could carry this industry to a dramatic stop, bringing about unanticipated desperate ramifications for all aspects of the purchaser economy, as indicated by the cybercrime organization.

11/04/21

OOCL warns customers of bank scams

Orient Overseas Container Line, warns its customers about the increase of fraudulent activities by employees using the name OOCL without authorization via suspicious mailboxes, in order to retrieve certain bank transfers.

OOCL gives advice to its customers such as:

If you want to contact OOCL, use reliable methods.

Report phishing attempts and emails that appear fraudulent

At the same time, during the previous months, the Intel 471 Cybercrime Department has observed network access brokers selling credentials and other forms of access to transportation and logistics companies. These information leaks are very problematic especially since these are companies operating billions of dollars worth of sea, land and air transportation. Especially at a time when the sector is struggling to stabilize.

11/04/21

CMA CGM invests in the Port of Los Angeles

The French shipping company is investing in Fenix marine service in order to acquire the largest container terminal in the Port of Los Angeles and consolidate its port handling. The cost of the operation amounts to $2.3 billion.

With the prospect of acquiring the port assets of the Bolloré Group, CMA CGM is investing in all links of the supply chain.

Fenix Marine Services is a 145-person company that operates one of the largest deepwater terminals at the Port of Los Angeles ($2.3 million of the California port’s $9.2 million in 2020),

With the economy recovering, it is even more important to invest in port infrastructure. CMA CGM inherits a tool, with a linear quay of 1.2 km lined with four berths, in which $100 million has been invested since 2017, in particular to increase its capacity by 40%, by equipping it with state-of-the-art equipment, automation of the chain is the priority.

The location of Fenix Marine Service operating in the Port of Los Angeles is also part of the deal price. Its location allows it to be on the busiest route, the east-west lines. 21% of container ships were deployed between Asia and North America in September according to Alphaliner’s latest count

11/03/21

Maersk invests in air freight

Maersk, the leader in maritime transport, is expanding its air fleet with its company Star Air, a strategy similar to that of CMA CGM.

Maersk has just ordered two B777Fs and three B767-300Fs, i.e. 5 Boeing aircraft to expand its fleet.

The strategic goal of Søren Skou, CEO of Maersk is to provide an end-to-end supply offer for these customers. Another goal for the shipping company is to be CO2 neutral by 2050 by using only biofuels according to IATA guidelines.

Maersk is arming itself with the airline Star Air to operate and maintain its aircraft. The group also confirms its intention to acquire Senator International, a German freight forwarder specializing in air freight, which represents 65% of its turnover for the sum of $644 million.

As for its port handling business, sales rose from $816m to $1bn between the third quarter of 2020 and 2021. Up 9.6%, volumes were unsurprisingly driven by port dynamics in Asia and North America, the point of departure and arrival of amphetamine cargo of unprecedented consumption.

“Growth in shipping activity is expected to lag behind growth in global container demand, which is expected to grow by 7-9%” in 2021

For 2021-2022, the forecast for cumulative capital expenditures remains unchanged at approximately $7 billion.

11/02/21

In the company Cosco Shipping, the chairman has changed.

After six years at the helm of the world’s largest marine company, Xu Lirong, who has reached the mandatory retirement age of 65, will step down. He is succeeded by Wan Min, who becomes the company’s chairman.

Cosco has said that procedures would be followed in order to implement the modification in accordance with applicable laws and regulations.

11/02/21

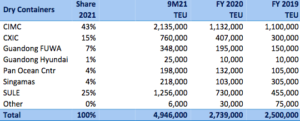

The market for container manufacturing

The market for marine container manufacturing is dominated by China, with 96 percent of sealed containers and 100 percent of refrigerated containers produced there. Conteneur output has increased by 208 percent in the last nine months compared to the same period last year, totaling 4,95 MEVP.

Conteneurship has become a very profitable company, especially with the rise in duty-free rates. They were worth between $1,650 and $1,750 each EVP by the end of 2019. According to industry experts, they have been trading at a price close to $3500 since the end of 2020. Furthermore, the container manufacturing market is divided into three Chinese companies: China International Marine Containers, Shangai Universal Logistics Equipment, and CXIC.

According to Alphaliner, the world’s first 100 marine container shipping companies are now operating over 24,44 MEVP on more than 5 460 port-conteneurs. On this total, 11,39 MEVP come from a single maritime company, Maersk, which ranks first with a portfolio of 2,36 MEVP, and China United Lines, which ranks last with 599 EVP.

10/27/21

Shipping companies invest in the supply chain

With their profits, shipping companies are expanding into the supply chain to ensure better revenue reliability.

Recently, there have been few mergers or acquisitions involving shipping lines, the most significant being the acquisition of NileDutch by Hapag Lloyd.

CMA CGM and Maerk are making logistics company integrations a priority. One example is CMA CGM, which acquired the worldᵉ s 5th and 10th largest freight forwanding company through the acquisition of Ceva Logistics. For Maersk, the investment was in two logistics companies that are Visible Supply Chhain Managmeent and B2B Europe Holding for 838 and 86 million euros. As for them, Alibaba and Amazon are much more enterprising, the American giant to ship more than 4.2 million packages with FedEx, moreover it would control 21% of the U.S. market martimes just behind UPS and FedEx.

10/27/21

LNG infrastructure expands in the Mediterranean

Avenir LNG has been delivered a new bunker to be deployed in Italy from Sardinia. The Mediterranean has two new LNG entrants, Avenir LNG’s Avenir Aspiration and a small LNG carrier from the European energy company.

The Avenir Aspiration has a capacity of 7,500m3 and is the first vessel of Nantong CIMC Sinopacific Offshore & Engineering, the third bunker vessel of Avenir LNG. It will operate as a ship-to-ship in the Mediterranean area.

A new LNG terminal in Ravenna in Northern Italy, it is the result of the cooperation between Knutsen and Edison giving the Ravenna Knutsen, it has a capacity of 30,000m3 divided into 3 tanks, the 179m long LNG tanker was built by the South Korean HHI. The vessel is operated by Knutsen under a 12-year project.

10/12/21

Walmart rents its own container ships to meet its supply needs

In order to respond to the disruptions in maritime freight, the American giant Walmart has decided to rent its own container ports to move its products as quickly as possible. The aim is to avoid congested ports, secure space on the ships and have a more or less stable supply.

To overcome the shortage of 40-foot containers, Walmart decided to use 53-foot containers. This solution is one of the reasons why Walmart has had almost no stock shortages.

These congestions benefit shipowners such as Maersk and Hapag-Lloyd with the soaring freight rates. On the main lines, transport can cost up to $20,000. Genco Shipping & Trading is seeking approval to certify their bulk vessels to carry containers temporarily in an attempt to meet the demand.

10/07/21

21% of container ships deployed between Asia and North America

The share of container ships operating on the trans-Pacific route is set to increase by 4% this year, from 17% in 2018 to 21% in 2021, which is as much as the Asia-Europe route. European shipowners such as Maersk, MSC and CMA CGM provide the majority of the China-Europe routes. As for the Asia-America route, it is managed by Chinese freight companies.

An exception is made by CMA CGM which has 25% of its fleet for transpacific routes, which is explained by their takeover of NOL and its sub-brand APL.

Only two companies have had to change their profiles, with Taiwan’s Wan Hai shifting to Asia-America routes at 34% of its fleet, for comparison in September 2018, fleet capacity was only 7%. The shipowner with the largest offer is Israel’s ZIM with 54% offer.

10/06/21

Sea freight rate down

The Shanghai Containerized Freight Index (SFCI), the benchmark index for containerized freight from Shanghai to major ports, recorded the first decline since 2020 of 0.6%. This is the first stabilisation in 5 months and is linked to Golden Week. Rates are expected to remain stable until the first quarter of 2022, when they will be able to catch up with all the delays caused by the high demand, the shortage of containers and the congestion of ships in world ports. The SFCI has announced a 226% increase in freight rates this year.

Yet, rates are not expected to rise, with another 300 container ships waiting in Chinese and US ports and a week-long holiday in China.

The Shanghai Containerized Freight Index (SFCI), the benchmark index for containerized freight from Shanghai to major ports, recorded the first decline since 2020 of 0.6%. This is the first stabilisation in 5 months and is linked to Golden Week. Rates are expected to remain stable until the first quarter of 2022, when they will be able to catch up with all the delays caused by the high demand, the shortage of containers and the congestion of ships in world ports. The SFCI has announced a 226% increase in freight rates this year.

Yet, rates are not expected to rise, with another 300 container ships still waiting in Chinese and US ports and the week-long holiday in China.

10/02/21

Congestion in California at the height of the season

Congestion is increasing in the world’s major ports, particularly in California, where the situation is becoming critical as the high season approaches.

The causes of congestion in Los Angeles are mainly due to the accelerated recovery of activity in the spring of 2020, with very large volumes coming in, which meant that the ports could not keep up with the pace of freight. As a result, container ships are forced to stay at anchor outside the ports to wait to be unloaded. In September 2021, the average number of ships at anchor was 60, with 20 ships being unloaded each day. With congestion, lack of manpower due to understaffing, sick leave for Covid-19 and lack of space in the ports, unloading takes much longer than it should, on average containers wait 6 days on the quay before being put on chassis. The shortage of chassis starting in 2020 has still not been solved in 2021, which further increases the delays.

Finally, the shortage of drivers for loading and unloading does not allow covering the demand, which makes the delays even longer. Finally, the warehouses are totally saturated, thus aggravating the congestion upstream of the supply chain.This congestion is driving up freight prices exponentially, with a shipment from China to the US West Coast once costing around $3-5,000 and now costing between $15-20,000. Port fees are rising to $750, storage costs are becoming very high until some companies are abandoning their goods.

The federal government is intervening to alleviate the disruption, with measures to encourage 24/7 operations. Some experts believe that the congestion problems may extend into the Chinese New Year of 2022.

09/30/21

Electricity shortage in China

China is the world’s largest consumer of energy and the largest source of greenhouse gases, and relies on coal-fired power plants for its energy needs. The tightening of CO2 emission standards and the difficulty in obtaining coal supplies are causing power shortages in China, slowing down its growth. Rising coal prices and the complexity of coal supply is causing power production to decline, resulting in power outages as winter approaches, mainly affecting industrial centers on the coasts and in the south as well as some residential areas in the northeast.

China is revising its GDP forecast downwards from 8.2% to 7.7%.

The measures put in place by the Middle Kingdom, as in the city of Huludao, are not to use high-energy consumption appliances such as microwaves and water heaters between 10:00 am and 12:00 pm, 3:00 pm and 4:00 pm as well as 7:00 pm to 8:00 pm. Shopping centers close at 4:00 pm.

The impact of these shortages will affect many sectors across the country such as aluminum production, chemicals, soybean meal, …

This will affect global sectors such as textiles and toys. The major coal producers in China have come together to address the shortages and curb the price of coal so that Chinese people can keep their homes warm during the winter.

09/27/21

Congestion in global hubs

The tail of container ships in the world’s ports continue to grow. Nearly 150 ships are at anchor in global hubs from San Pedro Bay to the port of Ningbo. Typhoon Chanthu hit southern China disrupting shipping and paralysing some container and bulk terminals. Operations have gradually resumed this week, but are not yet at 100% capacity.

As a result, 50 container ships are blocked at the ports of Ningbo and Zhoustant and 27 are queuing at the port of Shanghai.

The situation is not improving in Los Angeles either, where 65 container ships are at anchor, 23 of which have been forced to drift for lack of space.

In Los Angeles, the number of days for a berth is a record 8.7 days. VesselsValue estimates that there are 141 container ships waiting in Chinese and US ports, 54 more than last week.

09/18/21

Cargo situation in China

The situation in the airports is becoming problematic, with the reinforcement of the measures against Covid, the airports are only at 60% of their usual capacity. Reducing the frequency of flights and their capacity. The companies are chartered for the year and no longer depend on the airlines, so there is little space for the public. This situation occurs in Chengzhou, Nancheng, Shanghai, Beijing and Guangzhou. Goods departures are 10 days in advance when flights are not cancelled.

Sea freight is not getting any better either with the Typhoon hitting eastern China causing cancellations, the Chinese festival due on 11 November increasing shipment volumes, poor traffic conditions between China and France cancelling shipments since 15 August and transferring them by air freight.

Many people are turning to rail freight, but the situation means that many trains are overcrowded and the transport time is becoming longer than sea freight.

Freight costs and transit times will continue to rise over the next 3 weeks.

09/16/21

French ports making progress in shipper satisfaction

Eurogroup Consulting has just published a study with the Association of freight users on the satisfaction of shippers operating in French ports. The study, carried out with a majority of shippers in the food, chemical and distribution sectors, reveals that ⅓ of shippers organise their transport themselves, ⅓ use a service provider and ⅓ use both options.

Shippers choose the ports where their goods transit according to several criteria, the price of transport, the price due to transport, the presence of shipping company and the cost of transactions. Of the shippers surveyed, 57% were satisfied, 16 points more than last year. Dunkirk is the most satisfied port with 88% of shippers, followed by Marseille with 62% and 43% for Haropa le Havre, against 75% for the ports of Antwerp and Rotterdam. Despite lower performance due to numerous delays, availability of equipment and the sharp rise in freight costs, progress is being made in terms of ease of movement of goods, transparency of costs, handling of goods and easy monitoring of operations.

09/15/21

DocShipper Advice: You can count on DocShipper if you’re in need of any packaging and protection service to relive. Do not hesitate to contact us.

Supply disruption in the US

Due to the numerous shipping congestion around the world, US exports are at an all-time low, while empty container shipments are at an all-time high. Major US retailers fear shortages in shops due to rising freight costs and delivery delays.

09/13/21

Supply disruption in the US

Due to the numerous shipping congestion around the world, US exports are at an all-time low, while empty container shipments are at an all-time high. Major US retailers fear shortages in shops due to rising freight costs and delivery delays.

09/13/21

CMA CGM to stop spot rate increases

In an effort to improve customer relations, CMA CGM will suspend spot rate increases from 9 September 2021 until 1 February 2022.

With congestion in ports and increasing delays due to high demand and low transports capacity, freight rates are rising. For this reason, the French group CMA CGM, will stop the increases in spot freight rates for Containerships, ANL, APL, CNC, Mercosul. To strengthen its services and increase its capacity, CMA CGM has increased its fleet by 11% by purchasing new and second-hand vessels as well as 780,000 TEU.

09/09/21

The first zero emission container ship

The Zero Emission Services (ZES) project led by Engie, the Dutch bank ING and a Finnish equipment manufacturer, successfully launched the first zero-emission river container ship, the Alphenaar with a capacity of 104 TEU, powered by lithium-ion batteries on 6 September. The first company to inaugurate the container ship on the Rhine is the famous brewer Heineken.

For the moment, only one charging station is available for exchanging the ship’s batteries, but ZES plans to have 30 by 2030. The interest of these terminals is to be able to directly exchange the batteries with the fully recharged one, allowing the ship to start operating again.

09/07/21

The first zero emission container ship

The Zero Emission Services (ZES) project led by Engie, the Dutch bank ING and a Finnish equipment manufacturer, successfully launched the first zero-emission river container ship, the Alphenaar with a capacity of 104 TEU, powered by lithium-ion batteries on 6 September. The first company to inaugurate the container ship on the Rhine is the famous brewer Heineken.

For the moment, only one charging station is available for exchanging the ship’s batteries, but ZES plans to have 30 by 2030. The interest of these terminals is to be able to directly exchange the batteries with the fully recharged one, allowing the ship to start operating again.

09/07/21

DocShipper Advice

DocShipper Advice : For all your logistics operations, don’t hesitate to contact our DocShipper agents! Our logistics department will be happy to help you with all your requirements.

New complaints to the FMC over carrier cargo discrimination

With heavy congestion in major world ports, some carriers are not treating all goods equally. They allow themselves to pick and choose which goods they want to ship due to high demand and numerous delays.

Chemical importers are complaining to the Federal Maritime Commission (FMC), the Biden administration is asking carriers to comply with the US Shipping Act “prohibiting carriers from unreasonably refusing to handle cargo”. Refusal to transport these hazardous materials, which are used in many products, could lead to shortages and damage the US economy.

The companies accused of these practices are MSC and Cosco for failing to meet its contractual obligations to a manufacturer of mass-market items, MCS. These allegations have been hotly contested and MSC has decided to fight back with a defamation suit.

09/06/21

Chinese company Cainiao is revolutionizing the delivery of goods

The company Cainiao was founded in 2014, is now a subsidiary of the $10 billion giant Alibaba. The company’s goal is to create an open platform hosting an ecosystem of logistics companies to connect them and have shared and transparents customs information labelling standards. The company has 3,000 logistics partners, 3 millions couriers and the top 15 delivery companies in China and 100 international operators working together. The solution allows a 1 kg parcel to be sent anywhere in China for 30 cents in 24 hours. The goal is to deliver a package anywhere in the world for $3.

In Hangzhou, a city of 10 million people where Cainiao’s depot is located, the company has launched autonomous vehicles measuring 1 metre by 1.5 metres that use 360-degree cameras to allow people to pick up and drop off their parcels through doors on the sides of the vehicle. The Xiao G autonomous vehicle will enable faster deliveries in China’s major cities.

The aim of this ecosystem is to optimize delivery networks and make progress for the environment by reducing unnecessary packaging, stock and polluting fuels. The objective is to buy on Alibaba, Taobao, pay through Ant Financial and be delivered by Cainiao.

Chinese company Cainiao is revolutionizing the delivery of goods

The company Cainiao was founded in 2014, is now a subsidiary of the $10 billion giant Alibaba. The company’s goal is to create an open platform hosting an ecosystem of logistics companies to connect them and have shared and transparents customs information labelling standards. The company has 3,000 logistics partners, 3 millions couriers and the top 15 delivery companies in China and 100 international operators working together. The solution allows a 1 kg parcel to be sent anywhere in China for 30 cents in 24 hours. The goal is to deliver a package anywhere in the world for $3.

In Hangzhou, a city of 10 million people where Cainiao’s depot is located, the company has launched autonomous vehicles measuring 1 metre by 1.5 metres that use 360-degree cameras to allow people to pick up and drop off their parcels through doors on the sides of the vehicle. The Xiao G autonomous vehicle will enable faster deliveries in China’s major cities.

The aim of this ecosystem is to optimize delivery networks and make progress for the environment by reducing unnecessary packaging, stock and polluting fuels. The objective is to buy on Alibaba, Taobao, pay through Ant Financial and be delivered by Cainiao.

COSCO SHIPPING development announces these results

COSCO SHIPPING development is a Chinese state-owned company formed from the merger of Cosco and China Shipping Group to become one of the world’s largest shipping companies specialising in the provision of financial services complementary to supply services. Specifically, the company carries out financial operations of maritime transport, providing leasing services, investment, service proposal as well as container manufacturing. It aims to incorporate industry and finance between different financial companies in order to create a collaboration between several companies.

In the first half of 2021, the company achieved a turnover of just over $2 billion with a profit of $375 million, an increase of 201% over last year. These results can be explained by a strategy of integrating industry and finance, promoting production and finance. It aims to enrich its rental services, the implementation of specific and refrigerated containers to improve its profits.

This increase is explained by the improvement of health conditions, making the Chinese economy and maritime transport take off again. The strong demand for sea freight has enabled the company to record a 230% increase to 620,000 TEUs in the first half of the year.

With its profits, the company is reinvesting in technological innovation to improve the productivity of its supply chain and the automation of shipping finance. COSCO SHIPPING Development is protecting its investors by promoting a stable dividend plan and raising funds

08/31/2021

Tip DocShipper : In case you need assistance during your expedition contact a team of professionals who will help you manage your project’s workflow

Logistics situation in China

Cases of Covid in China are disrupting traffic at some of the country’s international airports. Notably, Shanghai Airport, China’s leading cargo processing airport, has been forced to reduce its customs processing and handling capacity due to the closure of one of its cargo terminals and significantly cancel some civilian flights further reducing air cargo capacity. Zhengzhou Xinzheng Airport, China’s largest airport, had to close its doors, making it even more difficult to supply goods to/from China.

To adapt to this situation, the Bolloré Logistique Group has reacted by reorganizing its logistics to other airports still in operation, such as Hong Kong. It is therefore to be expected that delays and additional costs will be incurred, especially as many Chinese ports are paralysed at the same time, increasing the demand for air freight. This is why it is important to plan your shipments in advance in order to ensure that you have enough space to load your goods.

Do not hesitate to contact our experts to make sure you have enough space for your goods.

Sea freight delays are set to worsen in China due to the Chinese holidays and weather conditions.

The ports of Ningbo and Shanghai will suspend operations from 12 to 14 September due to Typhoon Chanthu off the coast. Holidays will also slow down traffic, the first being Mid-Autumn from 19 to 21 September and Independence Day from 1 to 21 October. It is therefore important if you wish to make shipments during the month of October to inform the companies in advance.

08/31/2021

Congestion and delays in global shipping

Congestion in the ports is becoming increasingly important, resulting in numerous delays. Only 40% of ports respect their arrival dates, the average delay of ships is 6.88 days. There are several explanations for these delays, the first being the Ever Given incident in the Suez Canal, which paralysed part of the world’s transport for several months. The major Chinese ports of Yantian and Ningbo were closed due to the health situation, causing numerous supply delays.

The most reliable company is the Danish carrier Maersk, which meets more than 47% of its deadlines, while Evergreen is the least reliable company with only 16.2% of its deadlines met.

The shipping companies are cutting some crossings or stops to stem the traffic, which is causing further delays.

Congestion and delays in global shipping

Congestion in the ports is becoming increasingly important, resulting in numerous delays. Only 40% of ports respect their arrival dates, the average delay of ships is 6.88 days. There are several explanations for these delays, the first being the Ever Given incident in the Suez Canal, which paralysed part of the world’s transport for several months. The major Chinese ports of Yantian and Ningbo were closed due to the health situation, causing numerous supply delays.

The most reliable company is the Danish carrier Maersk, which meets more than 47% of its deadlines, while Evergreen is the least reliable company with only 16.2% of its deadlines met.

The shipping companies are cutting some crossings or stops to stem the traffic, which is causing further delays.

In Los Angeles, the situation is becoming critical, with a world record 36 containers on hold due to ship delays, cargo being unloaded but not repatriated due to lack of manpower in the ports as demand continues to grow. The waiting time for container ships is over 5 days and the average waiting time for containers is 8.3 days.

Port

Rotterdam

Pireaus

Hamburg

Felixstowe

Antwerp

Gioia Tauro

Bremen-Bremerhaven

Valencia

Tangier Med

Southampton

Malta

Barcelona

Algeciras

Number of container ships in queue

12

6

5

2

2

2

2

1

1

1

1

0

0

In Europe, the most congested port is Rotterdam, ahead of the Greek port of Piraeus and the German port of Hamburg. These logistical problems keep driving up the price of sea freight. For example, an Asia/US container had a price of $1,525/USF (40-foot container) last year and has now risen to $17,000/USF this year, an increase of over 1,000%.

Finally, in China the most critical point is in the north in the ports of Jingjiang, Qinhuangdao, Jinhou and Tianjin where the congestion of bulk carriers is the greatest, 207 of them are at anchor. It is estimated that 28% of the world’s bulk carrier fleet is congested, or 5.7%.

08/30/2021

Hurricane Ida hits New Orleans, paralysing its port

In the south-eastern United States, a hurricane hit New Orleans on the coast of Louisiana, creating major flooding due to torrential winds and rain. Hurricane Ida, with winds stronger than Hurricane Katrina, caused widespread damage in New Orleans, leaving the city without power and crippling container terminals at ports that stopped loading and unloading cargo. Ships diverted to the Mississippi to be less affected by the hurricane, causing Louisiana’s corn and soybean exports, representing more than half of the country’s, to stop. Also, the price of American petrol and natural gas rose as almost all production in the Gulf of Mexico was shut down.

08/30/2021

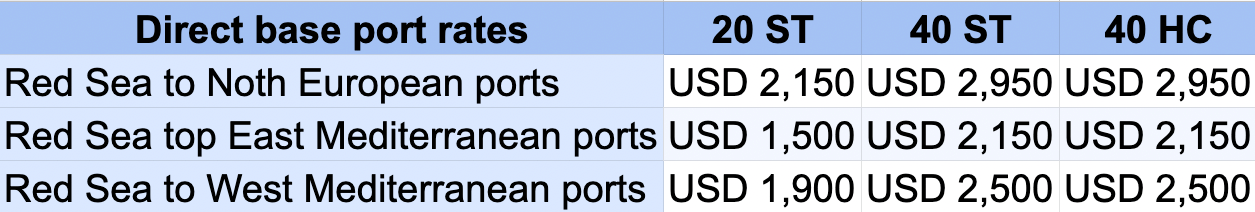

CMA CGM to raise tariffs in Europe

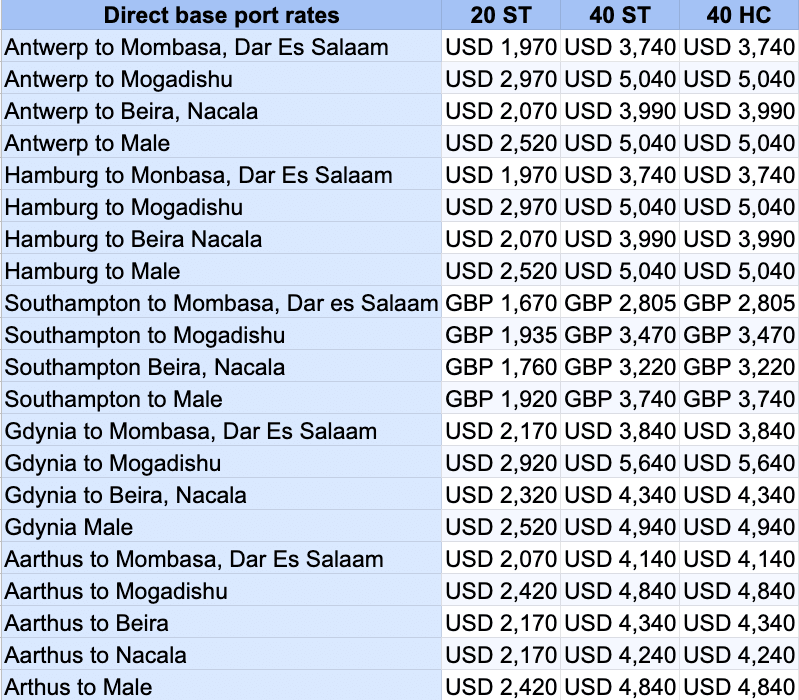

From September 1, the French shipping line CMA CGM will apply surcharges for all kinds of freight (FAK) from the Red Sea to all different ports in Northern Europe and the Mediterranean.

In addition, CMA CGM will also apply surcharges on dry, oversize and breakbulk cargo from Northern Europe, Scandinavia, the Baltic States and the UK to various African countries: Kenya, Tanzania, Mozambique, Somalia and the Maldives.

Finally, the French shipping company will also charge a surcharge of US$400 for reefer containers from Northern Europe and Scandinavia to East African countries.

08/24/2021

DocShipper Tip

DocShipper Tips : It’s not just about reaching for the established network of contacts but rather customizing the services that deliver the best results. In order to guarantee these results the wisest way is to contact the professionals

To protect personal data, China adopts the PIPL law

The National People’s Congress of China adopted a law on 20 August 2021 which will come into force on 1 November 2021. This law will allow the protection of personal data online. The PIPL (Personal Information Protection Law) restricts the collection, processing and protection of data in order to oblige companies to better secure the storage of personal data of its users. This law only applies to companies domiciled in China, its equivalent in Europe is the RGPD adopted in 2016. Earlier this year, the e-commerce giant Alibaba was fined $2.3 billion for abuse of a dominant position. The ministry continues its hunt and accuses 43 companies of illegally transferring user data abroad

08/20/2021

DocShipper Tip

DocShipper Advice : For all your logistics operations, don’t hesitate to contact our DocShipper agents! Our logistics department will be happy to help you with all your requirements.

Ningbo-Zhoustant port closes one of its terminals because of Covid

The port of Ningbo-Zhoustant, one of the most important ports in the world in terms of cargo, stopped?

The disruption to global cargo already affected by Covid will continue following a positive case in the port of Ningbo-Zhoustant. Despite extensive sanitary measures, one of the employees tested positive, forcing one of the terminals to close and 2,000 were placed in isolation.

Many delays will accumulate, the port will not be able to meet all the demands due to its new closed terminal handling 10 million containers

This new problem will not reduce the cost of sea freight, especially since new cases are appearing all over China, which can slow down the logistics of Chinese carriers and increase delays.

08/18/2021

Maritime freight prices rise with pandemic

With the rise of the variant delta in China, Chinese ports are requiring the testing of ships’ crews before they can disembark, further increasing delays. Congestion in Chinese ports is 76% higher than the average for the past 5 years, causing sea freight prices to soar.

However, the possibility of a national containment in China is very unlikely due to the massive vaccination of the country (60% of the population). Local containments are in place for several million Chinese, creating for example in the port of Yantian, the reduction of operations up to 70%.

The hypothesis of a general reconfinement in China would be catastrophic for the oil markets due to the reduced mobility of the Chinese.

For these reasons, the price of sea freight will continue to rise.

08/07/2021

Read More

You might be interested in these articles

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

- Coronavirus (Covid-19) impacts on import/export business

- How does Coronavirus impact international supply chain?

- 💡How to find a good product to sell?

- How to find your reliable supplier for your business? [Fair Trade Guide]

- AliExpress | Use the Chinese panacea to sell your products online

- How a sourcing strategy can rocket your margin?

Need Help with Logistics or Sourcing ?

First, we secure the right products from the right suppliers at the right price by managing the sourcing process from start to finish. Then, we simplify your shipping experience - from pickup to final delivery - ensuring any product, anywhere, is delivered at highly competitive prices.

Fill the Form

Prefer email? Send us your inquiry, and we’ll get back to you as soon as possible.

Contact us