US Tariffs Trigger Chaos in Freight Markets 2025

Introduction: The global freight landscape has been dramatically transformed since the implementation of sweeping US tariff changes in early 2025. These policy shifts have created

Impact of Global IT Outage on Air Cargo and supply chain

In an unforeseen and highly disruptive event, a global IT outage involving Microsoft systems has cast a long shadow over the air cargo and broader

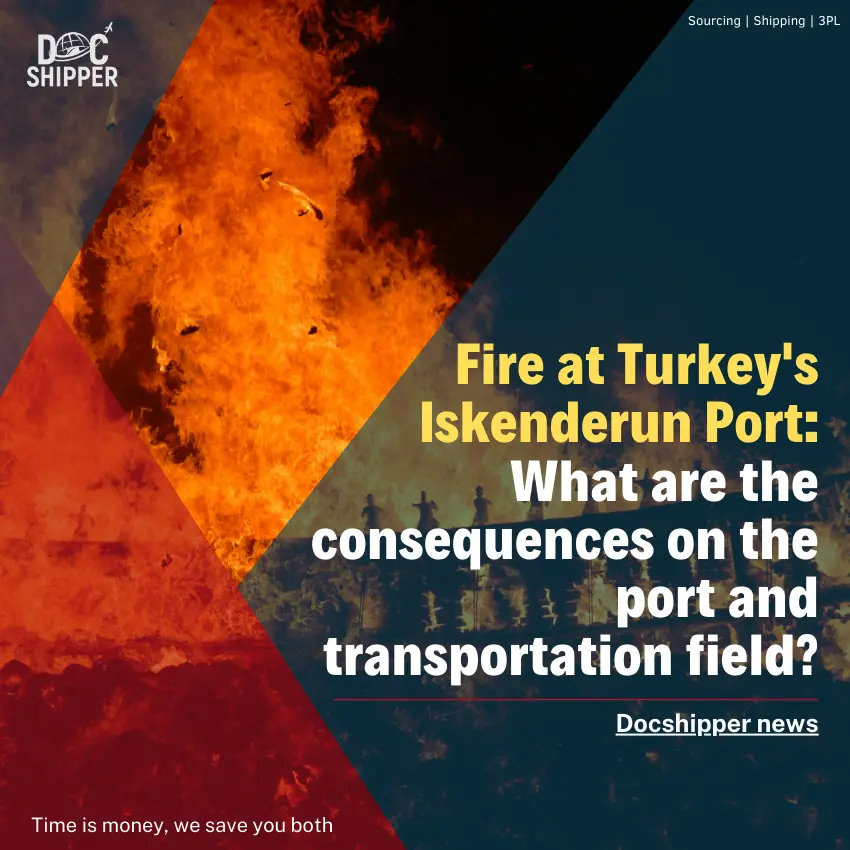

Fire at Turkey’s Iskenderun Port: what are the consequences on the port and transportation field?

This Monday, February 6, 2023, unfortunately, the Middle East, mainly Turkey, and Syria have been affected by a very important earthquake of magnitude 7.5 that

DocShipper News

In a world of fast-moving information, especially in the world of international trade, it is difficult to keep up with all the news. That’s why