Introduction

The red sea crisis fundamentally continues to reshape global logistics as we navigate through the end of 2025. What began as a regional security concern has evolved into one of the most significant shipping disruptions in modern maritime history, forcing the international shipping industry to rapidly adapt its strategies and operations.

Why this red sea crisis update matters now: With the situation showing no signs of immediate resolution, understanding the current state, available alternatives, and cost implications has become critical for businesses managing international supply chains. This comprehensive analysis provides you with the latest data, expert insights, and actionable strategies to navigate these challenging waters.

Understanding the Red Sea Crisis: Current State and Timeline

The Red Sea Crisis, sparked by Houthi militant attacks on commercial shipping in a vital global trade chokepoint, has evolved through periods of intense disruption, intermittent escalations, and recent signs of de-escalation tied to broader regional ceasefires. This strategically important waterway, carrying 12-15% of international maritime trade, continues to influence shipping routes and costs amid shifting security dynamics.

Key events of the red sea shipping crisis

The red sea crisis escalated dramatically in late 2023 when Houthi militants based in Yemen began targeting commercial vessels transiting the Red Sea and Bab el-Mandeb strait. This strategic waterway, which connects the Suez Canal to the Indian Ocean, typically handles approximately 12-15% of global maritime trade.

According to World Bank analysis, container ship transits through the Suez Canal plummeted by 90% between December 2023 and March 2024. Major shipping lines including Maersk, MSC, CMA CGM, and Hapag-Lloyd suspended Red Sea operations, redirecting vessels around Africa’s Cape of Good Hope.

Latest red sea crisis update and security developments

As of December 2025, the security situation remains volatile. Despite international naval efforts including Operation Prosperity Guardian, attacks on commercial shipping continue intermittently. The latest reports from July 2025 indicated renewed escalation, with several vessels reporting near-miss incidents.

Most major carriers maintain their policy of avoiding the Red Sea route, citing crew safety concerns and prohibitively high insurance premiums. This means the Cape of Good Hope route has become the de facto standard for Asia-Europe container traffic, fundamentally altering global shipping patterns.

Economic Impact of the Red Sea Crisis on Shipping Costs

The Red Sea Crisis has imposed substantial economic burdens on global maritime trade, driving up operational expenses and reshaping supply chain economics through widespread vessel rerouting. As carriers continue to favor the longer Cape of Good Hope path to mitigate risks, the disruptions have translated into persistently elevated costs across freight, insurance, and logistics.

Freight rate increases due to the red sea crisis

The economic ramifications of the Red Sea shipping crisis have been substantial and persistent. Freight costs on key Asia-Europe routes increased by 40-60% in the immediate aftermath, though rates have since stabilized at levels 25-35% above pre-crisis benchmarks.

Data from JPMorgan’s supply chain research indicates that the longer Cape of Good Hope route adds approximately $200-400 per TEU in additional costs, factoring in fuel consumption, crew wages, and vessel positioning expenses.

Insurance premiums and war risk surcharges

War risk insurance has emerged as one of the most significant cost factors during the red sea crisis. Premiums for vessels transiting the Red Sea increased from typical rates of $10,000-20,000 per voyage to $150,000-500,000, making the route economically unviable for most carriers.

Even vessels choosing alternative shipping routes face elevated baseline insurance costs due to market-wide uncertainty. Hull and machinery insurance premiums have increased industry-wide by 15-25%, according to maritime insurance brokers.

Extended transit times and operational costs

The rerouting necessitated by the red sea crisis adds 10-14 days to typical Asia-Europe transit times. This extended voyage duration creates cascading operational impacts:

- Increased fuel consumption: An additional 3,500 nautical miles requires 800-1,000 tons more fuel per voyage for large container vessels

- Crew costs: Extended voyages mean higher crew wages and provisioning expenses

- Capital tied up longer: Goods spend nearly two additional weeks in transit, impacting cash flow and inventory management

- Schedule reliability: Longer routes strain vessel schedules, reducing service frequency on affected trade lanes

Research from the International Transport Forum estimates the total additional cost to global trade at $15-20 billion annually while the red sea disruption persists.

DocShipper info

The Cape of Good Hope route doesn’t just add fuel costs, it changes your total landed cost:

- extra inventory holding

- higher working capital exposure

- increased demurrage risk

- insurance premium variations by carrier and route

Many companies still compare freight rates only, and lose money silently.

👉 DocShipper analyzes your full cost structure and identifies where savings are still possible despite longer routes. Get a free total-cost optimization review.

Alternative Shipping Routes: Bypassing the Red Sea Crisis

The Red Sea Crisis, which erupted in late 2023 amid escalating attacks by Houthi militants on vital shipping routes, continues to disrupt one of the world’s most crucial trade arteries. Connecting the Suez Canal to the Indian Ocean and facilitating 12-15% of global maritime commerce, this waterway’s instability has triggered widespread economic repercussions, including vessel rerouting and heightened operational costs.

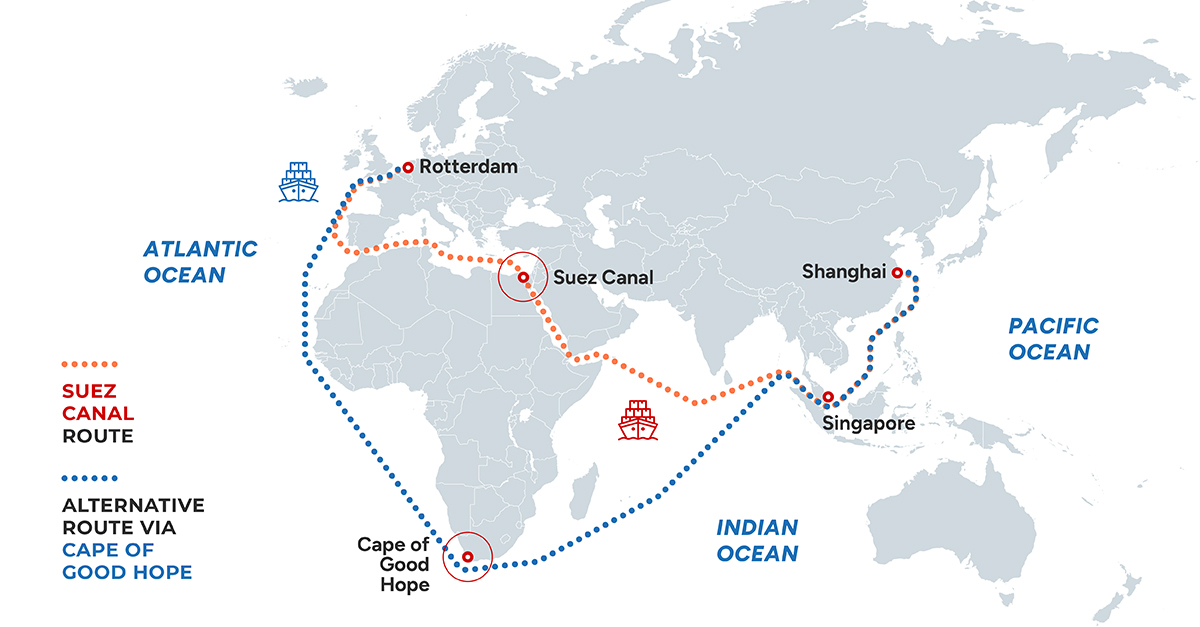

Cape of Good Hope: The primary alternative to red sea route

The Cape of Good Hope route around southern Africa has become the primary alternative for Asia-Europe container shipping during the red sea crisis. This historical maritime passage, once eclipsed by the Suez Canal’s efficiency, has experienced a renaissance by necessity.

The Cape route offers several advantages beyond security:

- Predictable transit times: Without canal scheduling constraints or security delays

- No canal fees: Eliminating the $300,000-700,000 Suez Canal transit cost per vessel

- Operational flexibility: Vessels can adjust speed to optimize fuel consumption

- Weather considerations: Although facing rougher seas, modern vessels handle Southern Ocean conditions well

Suez Canal alternative routes comparison

While the cape of good hope route dominates, shipping companies have explored other suez canal alternative routes with varying degrees of success:

Route | Distance (Asia-Europe) | Transit Time | Additional Cost/TEU | Security Risk |

Suez (Pre-Crisis) | ~10,000 nm | 28-32 days | Baseline | High |

Cape of Good Hope | ~13,500 nm | 38-42 days | +$200-400 | Low |

Panama Canal | ~18,000 nm | 45-50 days | +$500-700 | Low |

Trans-Siberian Railway | N/A (multimodal) | 15-18 days | +$800-1,200 | Medium |

Cost-benefit analysis: Red sea crisis impact on routing decisions

Decision-making around routing during the red sea crisis involves complex calculations balancing cost, time, and risk. For most containerized cargo, the cape of good hope route presents the optimal balance:

Scenario Analysis: For a typical 10,000 TEU vessel operating on the Asia-Europe trade lane:

- Cape Route Total Cost Premium: $2-4 million per voyage (fuel, crew, time)

- Red Sea Insurance Premium: $300,000-500,000 per voyage (when available)

- Suez Canal Toll Savings: -$500,000-700,000 (offset against Cape costs)

- Risk Cost (potential incident): $50-200 million (vessel damage, cargo loss, delays)

This calculus clearly favours the Cape route for most operators, explaining why the red sea shipping crisis has produced such persistent behavioural changes in the shipping industry.

DocShipper Advice

While Cape routing is the norm, it isn’t optimal for every shipment:

- urgent or high-value cargo

- seasonal retail flows

- production-critical components

- cash-flow-sensitive inventories

Multimodal alternatives (rail, air-sea, hybrid routes) can outperform ocean-only strategies in specific scenarios.

👉 DocShipper builds shipment-by-shipment routing strategies based on cost, urgency, and risk tolerance, not one-size-fits-all solutions. Request a tailored routing strategy.

Regional and Industry Impact of the Red Sea Crisis

The Red Sea Crisis has unleashed significant disruptions across global supply chains, with varying degrees of severity felt in different trade routes and economic sectors, amid persistent rerouting and cost escalations. This pivotal waterway’s turmoil has not only hampered efficiency but also amplified vulnerabilities for businesses reliant on timely maritime logistics, leading to broader implications for international commerce.

Europe-Asia trade disruptions from red sea shipping crisis

The red sea crisis has disproportionately affected Europe-Asia trade flows, which historically relied heavily on the Suez Canal’s efficiency. UNCTAD reports indicate that maritime trade growth has stalled in 2025, with the red sea disruption cited as a primary factor.

Key impacts on regional trade include:

- European manufacturers: Extended lead times for Asian components strain just-in-time manufacturing models

- Retail inventory: Longer transit times force retailers to increase safety stock, tying up capital

- Seasonal goods: Fashion, electronics, and holiday merchandise face higher risk of delayed arrivals

- Perishable cargo: Fresh produce and temperature-sensitive pharmaceuticals face significant challenges

Industries most affected by the red sea crisis

While the red sea crisis impacts all maritime trade, certain industries experience particularly acute effects:

- Automotive Industry: European auto manufacturers importing Asian components face supply chain complexity. The added transit time disrupts synchronized production schedules, with some manufacturers reporting temporary production slowdowns.

- Electronics and Technology: High-value electronics face both shipping cost increases (proportionally smaller for expensive goods) and time pressure for product launches. However, the industry’s high margins allow better absorption of increased freight costs.

- Retail and Consumer Goods: Mass-market retailers operating on thin margins struggle most with the 25-35% sustained increase in Asia-Europe shipping costs. Many have been forced to raise consumer prices or accept reduced profitability.

- Chemicals and Industrial Materials: Bulk and specialty chemicals face tank container capacity constraints on alternative shipping routes, with some experiencing supply tightness.

- Energy Sector: While oil tankers have shown more willingness to transit the Red Sea with armed security, LNG carriers largely avoid the route, impacting European energy imports from Middle Eastern sources.

DocShipper’s Expert Analysis: Navigating the Red Sea Crisis

The Red Sea crisis has evolved from a short-term disruption into a defining challenge for global shipping and supply chain planning. In this context, decision-makers need more than fragmented updates, they require a structured, experience-based interpretation of how ongoing developments affect risk, cost, and operational continuity.

Our assessment of the red sea crisis outlook

Based on continuous monitoring of security developments, carrier behavior, and geopolitical factors, our assessment indicates the red sea crisis will persist throughout the end of 2025 and potentially into 2026. Several factors support this projection:

- Geopolitical complexity: The underlying regional conflicts show no clear path to resolution

- Carrier risk aversion: Even with improved security, insurance markets may maintain elevated premiums

- Alternative route normalization: As the industry adapts, returning to Red Sea routes becomes less compelling

- Contractual commitments: Long-term charter agreements now incorporate Cape routing assumptions

This extended timeline necessitates strategic adaptation rather than tactical workarounds. Businesses must build supply chain resilience assuming continued red sea disruption rather than waiting for a return to pre-crisis conditions.

Risk evaluation for shipping during the red sea crisis

DocShipper employs a comprehensive risk framework to evaluate shipping options during the red sea crisis:

Security Risk Assessment: We monitor daily security bulletins, naval advisories, and incident reports to provide real-time risk evaluations. While some carriers have resumed limited Red Sea operations with armed guards, we generally recommend the Cape route for clients prioritizing cargo security and schedule reliability.

Financial Risk Mitigation: Beyond baseline shipping costs, we help clients understand total landed cost implications, including:

- Insurance premium variations across routes and carriers

- Inventory carrying costs due to extended transit

- Potential demurrage and detention charges from schedule disruptions

- Currency fluctuation exposure over longer shipping periods

Operational Risk Management: Extended alternative shipping routes introduce operational challenges we help clients navigate, from booking space on capacity-constrained Cape services to managing customs documentation for rerouted cargo.

DocShipper’s Strategic Recommendations for the Red Sea Crisis

As the Red Sea crisis continues to reshape global trade flows, businesses must move beyond reactive measures and adopt a structured response framework. Effective navigation of this disruption requires both short-term decisiveness and long-term strategic clarity, balancing operational continuity with cost control and risk exposure.

Immediate actions to mitigate red sea crisis impact

For businesses currently managing shipments affected by the red sea crisis, we recommend these immediate actions:

- Verify carrier routing: Confirm your current and booked shipments are using Cape routing or acceptable alternatives. Don’t assume, carriers occasionally adjust based on perceived security improvements.

- Adjust inventory planning: Add 10-14 days buffer to your Asia-Europe transit time assumptions. Update your supply chain planning systems accordingly.

- Review insurance coverage: Ensure your cargo insurance explicitly covers cape of good hope route transits and includes war risk coverage regardless of routing.

- Lock in capacity: With many shippers competing for alternative shipping routes, secure space commitments with carriers or freight forwarders early.

- Communicate with customers: If you’re a manufacturer or retailer, proactively inform customers of potential delays or cost increases attributed to the red sea shipping crisis.

Long-term supply chain strategies amid red sea crisis

Beyond immediate tactical responses, the extended nature of the red sea crisis demands strategic supply chain evolution:

- Diversifying Supply Sources and Transport Modes

- Multi-origin sourcing: Companies are reducing their reliance on a single Asia–Europe route by building supplier relationships in other regions.

- Nearshoring opportunities: With freight costs staying high, some products may now justify being manufactured closer to end markets.

- Transport mode mix: For urgent, high-value goods, rail can offer a middle ground when air freight is too expensive.

- Rethinking Inventory Strategy

- Higher safety stock: Businesses are increasing buffer inventory to handle longer and more unpredictable transit times.

- Regional distribution hubs: Expanding or adding distribution centers in key regions helps limit exposure to any single shipping lane.

- Stronger demand forecasting: Better forecasting lowers the need for costly last-minute air shipments.

3. Updating Contractual Terms

- Reviewing Incoterms: Companies are reassessing whether EXW, FOB, or CIF terms best share the risks associated with the Red Sea situation.

- Refining force majeure clauses: Contracts now more explicitly address long-lasting disruptions like this one.

- Dynamic pricing mechanisms: Flexible terms are being introduced to account for fluctuating shipping costs.

DocShipper Advice

Even under optimistic scenarios, full Red Sea normalization may take 18–24 months after security stabilizes.

Companies waiting for a “return to normal” risk higher costs and lost competitiveness.

Leading shippers are already:

- renegotiating contracts

- adjusting Incoterms

- redesigning inventory buffers

- diversifying transport modes

👉 DocShipper helps you move from crisis response to long-term supply chain resilience. Book a complimentary strategic consultation.

Cost optimization during the red sea shipping crisis

While the red sea crisis has increased baseline shipping costs, strategic approaches can minimize the impact:

- Consolidation Opportunities: Maximize container utilization and consider LCL to FCL conversion for regular shipments. The longer transit times of the cape of good hope route make efficient space utilization more critical.

- Carrier Partnership: Develop strong relationships with carriers committed to alternative shipping routes. Long-term volume commitments can secure better rates and guaranteed space allocation.

- Flexible Timing: Where possible, align shipments with periods of lower demand on Cape routes. Avoid peak season surcharges by planning shipments strategically.

- Value Engineering: Review product specifications and packaging to reduce weight and dimensions, lowering per-unit shipping costs on routes with distance-based pricing.

Future Outlook: Red Sea Crisis Resolution Scenarios

As we approach the end of 2025, the Red Sea crisis enters a potentially pivotal phase. Recent developments, including a fragile Houthi ceasefire announced in late October tied to the Israel-Hamas peace deal, have sparked cautious optimism. However, with over 160 reported incidents since November 2023 and the ceasefire’s conditional nature, the future remains uncertain.

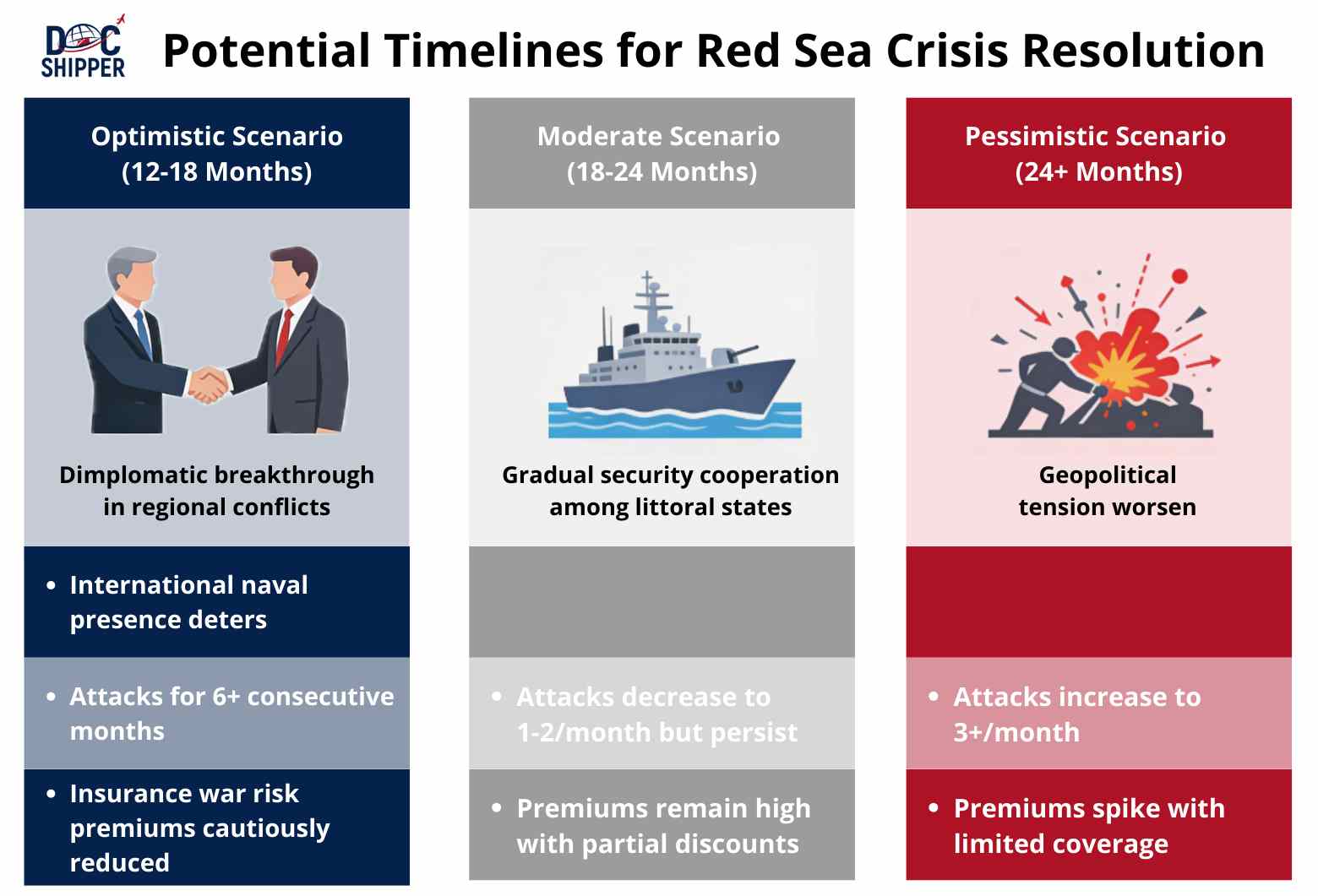

Potential timelines for red sea crisis resolution

The path to resolving the Red Sea crisis remains uncertain, with multiple scenarios possible depending on geopolitical developments and security improvements. Based on current intelligence and historical precedents for similar maritime disruptions, we outline three potential resolution timelines:

Optimistic Scenario (12-18 months): A diplomatic breakthrough in the underlying regional conflicts could lead to sustained cessation of attacks. In this scenario, international naval presence successfully deters incidents for 6+ consecutive months, gradually rebuilding carrier confidence. Insurance markets would cautiously reduce war risk premiums, making Red Sea transits economically viable again by late 2026.

However, even in this optimistic case, full normalization would take additional time. Carriers would initially test the route with less valuable cargo, gradually restoring service frequency as confidence builds. Experts estimate 18-24 months from security stabilization to full service restoration.

Realistic Scenario (2-3 years): The most probable timeline sees continued intermittent security incidents throughout 2026, with gradual improvement in 2027. Regional conflicts may reach stalemate rather than resolution, creating a volatile but manageable security environment.

Under this scenario, some carriers might resume limited Red Sea operations with comprehensive security measures (armed guards, convoy systems, enhanced insurance) by mid-2026, while others maintain Cape routing indefinitely. The shipping industry would operate in a two-tier system, with premium services using the Suez route at higher cost and standard services continuing via the Cape of Good Hope.

Pessimistic Scenario (3+ years): If regional conflicts intensify or spread, the Red Sea could remain effectively closed to commercial shipping for three or more years. This extended disruption would accelerate permanent shifts in global trade patterns, including:

- Infrastructure investment in alternative routes (expanded Panama Canal capacity, Arctic shipping development)

- Fundamental restructuring of supply chains away from Asia-Europe maritime dependence

- Permanent market share shifts to air freight and rail for certain cargo types

- Regional manufacturing development reducing need for long-distance shipping

Preparing for ongoing red sea disruptions

Regardless of the resolution timeline, businesses must proactively prepare for potential prolonged disruptions. The recent ceasefire offers hope, but with risks “suppressed rather than eliminated,” as noted by security experts, contingency planning is essential. Key preparation strategies include:

- Enhance Supply Chain Visibility: Invest in digital tracking tools and AI-driven analytics to monitor real-time route changes and predict delays. This can reduce the impact of unexpected rerouting by 20-30%, based on industry benchmarks.

- Build Redundancy in Logistics Networks: Diversify carriers and routes, incorporating hybrid options like air-sea combinations for critical shipments. For instance, establish backup agreements for Cape of Good Hope capacity to avoid peak-season bottlenecks.

- Strengthen Risk Management Frameworks: Conduct regular scenario-based audits, updating insurance policies to cover evolving war risks and extended transits. Collaborate with forwarders to model total cost impacts, including fuel surcharges and inventory holding expenses.

- Foster Agile Operations: Train teams on adaptive planning, such as dynamic inventory reallocation across regional hubs. For industries like automotive and electronics, this means shifting to modular production designs that accommodate variable lead times.

- Monitor Geopolitical Indicators: Stay ahead by subscribing to security bulletins from operations like Prosperity Guardian and tracking metrics like Suez transit volumes. Early detection of escalating tensions can provide weeks of lead time for adjustments.

DocShipper Alert

With Red Sea transits down up to 90% and Cape of Good Hope routing now the industry standard, companies face +10–14 days transit, higher inventory costs, and sustained freight premiums of 25–35%.

Most shippers underestimate the real impact:

- cash tied up longer in transit

- higher insurance and detention risks

- unreliable schedules affecting production and sales

👉 DocShipper helps you redesign routes, costs, and inventory strategy for a prolonged Red Sea disruption, not short-term fixes. Request a free crisis-impact assessment.

Conclusion

The Red Sea crisis, now stretching into its third year as of December 2025, has tested the limits of global logistics, but it also underscores the value of adaptive strategies and expert partnership. From soaring freight rates and extended transits to emerging signs of de-escalation like the Houthi ceasefire and increasing Suez returns, the landscape demands informed, proactive decision-making.

Don’t let the Red Sea crisis disrupt your operations, contact DocShipper today for a complimentary consultation on crisis-proofing your supply chain. Together, we’ll turn challenges into competitive advantages.

Read More

FAQ | Red Sea Crisis Update: Route Alternatives & Cost Impacts

The Red Sea Crisis, triggered by Houthi attacks on commercial vessels starting in late 2023, remains volatile but shows signs of tentative de-escalation. As of December 8, 2025, intermittent attacks continue, such as a recent incident involving a bulker exchanging fire with skiffs in the Bab el-Mandeb Strait. A fragile ceasefire tied to regional peace efforts was announced in late October, leading to the release of nine Filipino mariners on December 3. However, major carriers largely avoid the route due to ongoing risks, with some resuming limited Suez transits amid hopes for stabilization. Suez Canal transits are up year-on-year, but full normalization is uncertain.

The crisis has driven significant cost increases, with Asia-Europe freight rates stabilizing at 25-35% above pre-crisis levels after initial spikes of 40-60%. Rerouting adds $200-400 per TEU in fuel, crew, and operational expenses. War risk insurance premiums remain elevated at $150,000-300,000 per voyage, though down from peaks, contributing to an estimated $15-20 billion annual hit to global trade. Industry-wide hull insurance has risen 15-25%, and extended transits (10-14 extra days) tie up inventory and strain schedules.

The primary alternative is the Cape of Good Hope route around Africa, adding 3,500 nautical miles and 10-14 days but offering low security risk and no Suez fees (saving $300,000-700,000 per vessel). Other options include the Panama Canal (longer and costlier at +$500-700/TEU) and multimodal routes like the Trans-Siberian Railway (faster at 15-18 days but pricier at +$800-1,200/TEU). Most carriers favor the Cape for its balance of cost and reliability, though a potential Red Sea return could disrupt markets in 2026.

Resolution timelines vary: An optimistic scenario sees full recovery by mid-2026 if the ceasefire holds and attacks cease, potentially allowing widespread returns to the Red Sea. A realistic outlook points to gradual de-escalation by late 2026, with lingering high insurance and risks delaying full normalization. In a pessimistic case, disruptions could extend into 2027 or beyond if conflicts escalate, solidifying alternatives as the new norm. Geopolitical factors, like Yemen's ongoing conflict, will be key.

Immediate steps include confirming carrier routings, adding 10-14 day buffers to planning, reviewing war risk insurance, securing capacity early, and communicating delays to customers. Long-term strategies involve diversifying suppliers (e.g., nearshoring), mixing transport modes (rail or air hybrids), maintaining higher safety stocks, and updating contracts with flexible terms like dynamic pricing. Cost optimization through shipment consolidation and carrier partnerships can help minimize the financial strain while building resilience.

Need Help with Logistics or Sourcing ?

First, we secure the right products from the right suppliers at the right price by managing the sourcing process from start to finish. Then, we simplify your shipping experience - from pickup to final delivery - ensuring any product, anywhere, is delivered at highly competitive prices.

Fill the Form

Prefer email? Send us your inquiry, and we’ll get back to you as soon as possible.

Contact us