Are you an importer, exporter, or simply curious about the intricate world of global trade? In 2025, with global logistics evolving and new regulations emerging, customs clearance remains a crucial step in the shipping and supply chain process. Hence, if you want to minimize delays and complications, understanding the customs clearance process becomes a necessity.

In this article, we will provide a clear and effective overview, ensuring your goods navigate international borders smoothly.

What is customs clearance?

Customs clearance is the process of declaring an export or import of goods to customs. Typically, a custom clearance procedure can take between a few hours and 72 hours, but some delays are possible.

It’s really important for international trade, as it ensures compliance with regulations and payment of customs duties.

A smooth customs clearance service avoids delays and facilitates transport.

The main players include importers and exporters, who declare the goods; customs brokers, who streamline the formalities; and government agencies, which enforce compliance.

DocShipper Info

Docshipper Info: Need help with customs clearance? DocShipper can help you at every stage of the process to ensure smooth and stress-free customs clearance, from managing the administrative formalities to speeding up customs clearance. If you have any questions or need personalized assistance with customs formalities, our team of experts is at your disposal. Contact us for tailor-made assistance.

The Customs Clearance Process: Step-by-Step

Step 1: Preparing Your Shipment

Good packaging protects your goods, especially fragile or small items, from damage during transport. Clear labeling facilitates identification by customs officials, reducing the risk of error or delay.

Complying with the rules of the destination country is also important to avoid problems during customs clearance. This means checking restrictions and prohibitions, preparing the necessary documents, and of course, complying with the local regulations.

Step 2: Submitting Required Documents

This step involves providing customs officials with all the necessary paperwork for your shipment. These documents serve as proof of ownership, value, and origin, and are essential for determining duties and taxes. Common documents include:

- Commercial Invoice

- Packing List

- Bill of Lading (BOL) or Air Waybill (AWB)

- Certificate of Origin Import/Export Licenses (if applicable)

Errors or omissions in these documents can lead to delays, inspections, and even penalties, so careful preparation is crucial.

Step 3: Customs Declaration

To achieve a customs declaration form, you need to enter correct and precise information, such as the type of goods, quantity, and value. You must add all the necessary documents, such as invoices, certificates of origin, and customs clearance fees if required, and check the rules of the country of destination.

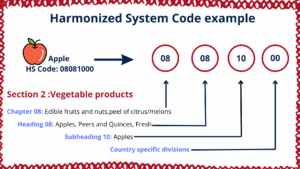

For fast and successful customs clearance, HS (Harmonized System) codes are important, as they are used to classifying goods and set customs duties and taxes.

Step 4: Customs Inspection

Customs Inspections are not automatic. They can be carried out randomly or if there are incomplete or dubious documents, or for specific products. Some products (like food, medicines, and electronics) are more closely monitored.

To be well-prepared, you need to have all your documents in order (invoices, licenses, certificates), use the right HS codes as we said earlier to properly identify your products, and comply with packaging and labeling standards. You can get in touch with Docshipper logistics expert to avoid mistakes related to the customs clearance process.

Step 5: Paying Duties and Taxes

Duties and taxes are calculated according to the value of the goods – the higher the value, the higher the charges.

The HS code determines the applicable rate, depending on the type of product; there may also be specific taxes depending on the country of destination, or trade agreements that may give duty reductions or exemptions.

This is an example of a calculation for the import of a smartphone into the United States, taking into account a customs duty rate of 20% for a smartphone manufactured in China.

Scenario Smartphone value: $500Transport and insurance costs: $50 Total customs value = $500 + $50 = $550

$550×20%=$110

$550×8%=$44

So in total, importing a smartphone made in China would cost $704, taking into account customs duties and taxes. |

The customs authorities accept some different payment methods:

- Online payment via official customs platforms,

- Bank transfers directly to the customs authorities.

- Payment via a forwarding agent or customs broker who handles the formalities for you.

Step 6: Release of Goods

Once customs clearance completed, the goods can be released by the customs authorities and sent to their final destination, whether to a warehouse, the chosen retailer, or directly to the customer.

Progress can then be tracked using the tracking number provided by the carrier.

Most carriers now provide online tracking platforms for delivery services or freight forwarders.

Key Documents for Customs Clearance

Commercial Invoice

The commercial invoice is a document that details the sale between buyer and seller. It’s important because it’s used by customs to calculate duties and taxes and to check that everything is in order.

Key information

- Product Description

- Value and quantity

- Weight

- Country of origin

- Terms of payment and delivery

Packing List

A packing list differs from a commercial invoice in that it doesn’t indicate the price of the goods, but only the number and contents of the packages.For Best practices for creating a packing list, you need to:

- Indicate the number and description of packages,

- Mention the dimensions and weight of each package.

- Check that the list matches before shipping.

Bill of Lading (BOL) or Air Waybill (AWB)

The BOL or AWB is a transport document that proves receipt of goods and enables them to be delivered. It is used for customs clearance and confirms ownership of the goods.

To ensure accuracy, check that the information on the BOL/AWB matches that on the commercial invoice and packing list.

Certificate of Origin

The certificate of origin indicates the country of origin of the goods and is used to determine the applicable customs duties.

It can be obtained from chambers of commerce or other competent authorities, depending on the country of origin.

Import/Export Licenses

Import or export licenses are required when the goods concerned are subject to restrictions or regulatory controls in the country of destination.

To apply for one, contact the local authorities or specialized agencies in your country.

Additional Documents

Depending on the specific goods being shipped, additional documents may be required.Let’s discover them :

- Certificate of Insurance proves that goods are covered in the event of loss, damage, or theft during transport. This is essential to protect the interests of both exporter and importer and to avoid litigation in the event of an incident.

- Phytosanitary Certificate which certifies that the Agricultural Products, such as fruit, vegetables, or plants, are free from disease or pests to ensure consumer health.

- Dangerous Goods Declaration for Hazardous Materials informs the authorities and the carrier of the risks associated with the goods and describes the safety measures required during transport.

Beyond these regulatory requirements, more and more companies are integrating sustainable logistics practices to minimize the environmental impact of their shipments while optimizing their costs

Common Challenges in Customs Clearance

As we’ve said, customs clearance is a key step in the import/export process, but it can be fraught with pitfalls. Here are a few common challenges faced by companies.

- Incorrect or incomplete documents: indeed, the absence of necessary documents or incorrect information can lead to delays or even fines.

- Customs detentions and delays: Customs authorities may detain goods to check compliance with local regulations. Problems such as missing documentation, product misclassification or incorrect samples can lead to this.

- Incorrect tariff classification: Each imported or exported product is subject to a tax based on its tariff classification. Incorrect assignment of these codes can result in additional charges or penalties, and sometimes even seizure of the goods.

- The impact of incorrect HS codes: in fact, they are essential for determining applicable customs duties and taxes. Incorrect application of these codes can lead to additional costs, delays, and disputes with customs authorities.

- Non-compliance with regulations: such as the omission of licenses or non-compliance with import/export restrictions (e.g. for specific products such as food, medicines, etc.) can result in severe fines and delays in delivery.

- Keeping up with changing regulations: it’s important to constantly check customs regulations, as they can change frequently, due to new legislation for example.

- Unforeseen taxes and duties: Customs duties, import taxes, and other charges can be difficult to estimate in advance. Sometimes, unforeseen costs arise due to changes in customs policies or the incorrect assessment of certain charges.

- Estimating costs in advance: Although companies try to calculate customs clearance costs in advance, additional costs can arise if the tariff classification is wrong, or if unforeseen costs arise during the process.

DocShipper Advice

What to Do If Costs Exceed Expectations? Unexpected costs can arise due to documentation errors, misclassification, or new taxes. To minimize the impact, DocShipper will ensure your products are correctly classified and, if possible, help negotiate costs with your logistics partners or authorities. Need help managing unexpected costs? Don’t hesitate to contact us!

Country-Specific Customs Clearance Requirements

Since each country has its own customs specificities, it is essential to ensure you know the local requirements to avoid delays or unexpected costs.

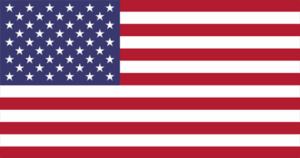

United States

Several documents are essential for successful US customs clearance: the Bill of Lading (B/L) or Air Waybill (AWB) for transport, the commercial invoice, and the customs declaration for calculating duties.

A Packing List specifies the contents of the consignment, while a certificate of origin may be required to benefit from trade agreements. Finally, some products require specific permits or licenses issued by the FDA, for example.

There is also the late or incorrect ISF (Importer Security Filing) declaration, which is mandatory for maritime imports and must be submitted at least 24 hours before the vessel’s departure.

DocShipper Alert

DocShipper Alert: The code for US exports must comply with Schedule B, which may differ from the HS code. DocShipper can help identify the correct Schedule B code to avoid non-compliance and optimize duties and taxes. For support, contact us to benefit from our expertise and secure your exports!

European Union

The European Union (EU) is like a free trade zone, where goods can move freely between its Member States without customs duties. However, specific customs rules apply to imports and exports from non-member countries.

Although customs procedures are largely harmonized within the EU, each Member State may have specific national regulations concerning particular products. Some countries also impose additional safety checks or certifications before products can be placed on the market. In addition, anti-dumping measures may apply to certain imported products.

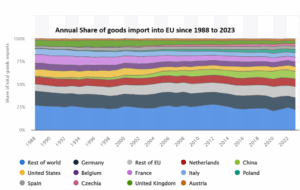

According to Statista, imports of goods from outside the European Union (EU) reached a total of 2,517.6 billion euros in 2023, compared to 16.3% on 2022.

China

China has unique and strict customs procedures, mainly managed by the GACC. Companies must be registered with the Customs General Administration to import/export, and China applies prior approval for certain products and import restrictions on sensitive goods such as food and technology

Tips for Importing/Exporting to China:

- Always include documents such as a commercial invoice, certificate of origin and import declaration.

- Check whether your product requires mandatory safety certification or inspection on arrival in China.

- Remain vigilant about import taxes, which can vary depending on the type of product.

- Customs clearance times can extend significantly during peak periods. For instance, Chinese New Year 2026 will create major port congestion from mid-January through February, with customs offices operating at reduced capacity. Planning ahead is critical to avoid costly delays

DocShipper Tip

Docshipper Advice: China’s product classification system differs from international standards. DocShipper will help you to prepare and validate your customs documentation and check the regulations specific to your goods. We will assist you in case of customs controls or issues to help you resolve them quickly.Contact our experts to get the right advice and avoid any risk of blockage or penalties.

Other Key Markets

Having examined the customs process in the USA , the EU and China, let’s explore other key markets that significantly influence global import, export, and international trade.

- Japan has strict customs rules, including for food, chemicals, and pharmaceuticals. Exporters must comply with Japan Customs regulations and provide accurate documents such as certificates of compliance. In addition, consumption taxes may be applied.

- India imposes import restrictions on certain products and has strict labeling standards. Exporters must verify the classification of products and submit an Import Declaration (Bill of Entry), as well as comply with the requirements of Agencies like the Food Safety and Standards Authority of India (FSSAI) for certain products.

- The UAE has modern customs regulations with strict safety requirements, especially for food and medical products. Required documents include certificates of origin, as well as export licenses for certain goods. Customs duties are generally set at 5% but vary depending on the product category.

Tips for Smooth Customs Clearance

1. Working with a licensed customs broker is essential to ensure smooth clearance. This professional specializes in complex customs laws and requirements, which minimizes the risk of delays or fines. An experienced broker can handle all the paperwork and ensure you submit the right documents at the right time, avoiding costly errors.

2. Using advanced technologies

Such as automated document management, can greatly simplify the customs process. These digital tools allow for more efficient management of the creation, tracking, and archiving of required documents, reducing processing time and reducing the risk of errors.

3.Trade agreements and changes in tariffs directly affect import/export costs and procedures. It is crucial to stay informed of the latest changes in customs regulations, whether they are bilateral agreements or new government policies. Using legal intelligence services or specialized platforms can help you to follow these developments in real-time.

4.Establish a transparent and collaborative relationship with customs authorities

It is a major asset to avoid complications during clearance. Working closely with these authorities, you can benefit from a better understanding of local requirements, the possibilities for facilitation in case of problems and early resolution of disputes.

5.It is essential to carry out regular audits of your customs compliance procedures to identify any gaps or errors in your practices. An internal audit ensures that you comply with all applicable regulations and that you can adjust your practices before they become problematic, thus maintaining a constant watch on the evolution of standards and procedures.

The Role of Technology in Customs Clearance

Digital tools are transforming the customs industry by making it easier to automate repetitive tasks and simplify the management of necessary documents. For example, document flow management platforms speed up the customs clearance process by enabling online submission, tracking, and validation of customs documents, reducing processing times and errors.

For example, AI-powered software now automates data entry, extracting key information from documents such as invoices, bills of lading and packing lists. This reduces the accuracy of customs declarations.

Machine learning algorithms can predict the likelihood of customs delays by analyzing historical data, customs trends and shipping patterns. This enables companies to optimize their shipping schedules and anticipate potential problems, leading to smoother customs clearance.

Generative AI tools can now create customized documents required for customs clearance, such as import/export licenses and certificates of compliance. This automation simplifies document preparation and ensures that companies are always compliant with the latest regulations.

Conclusion

Understanding the customs clearance process and having the right documents are essential to the smooth running of your international business. Rigorous management of customs procedures and careful attention to local regulations will not only speed up your deliveries but also avoid costly mistakes. Customs clearance is crucial to the success of international trade, as it ensures compliance with local laws and protects your products from unforeseen delays. Working with experts allows you to optimize this complex process and focus on what’s most important: growing your business.

At DocShipper, we understand the challenges of customs clearance and can help you simplify and secure your procedures. We provide a fast and reliable service, tailored to your specific needs. With us handling your logistics and shipping, including customs clearance, you can focus on growing your business. Contact us for a seamless and smooth import and export experience.

FAQ | The Ultimate Guide to Customs Clearance for Importers & Exporters

Customs clearance is the process of allowing goods to enter or leave a country after inspection by the customs authorities, verification of documents and assessment of the value of the goods, sometimes accompanied by a physical inspection to ensure compliance with local laws and taxes. Customs brokerage, on the other hand, refers to the services of a customs broker, a licensed professional who acts as an intermediary between importers/exporters and the customs authorities, taking care of the administrative and legal formalities to facilitate customs clearance and ensure the compliance of international trade transactions.

The time required for clearance can vary depending on many factors. Clearance generally takes between a few hours and 72 hours. Some goods, such as food or pharmaceuticals, may also require longer inspections.

While it is possible to handle customs clearance yourself, this can be complex, especially if you are not familiar with customs regulations. Engaging a customs broker is very advantageous to avoid costly errors.A broker can expedite clearance and minimize the various risks of the seizure of goods.

If your goods are seized by customs, this means that they have been detained for a specific reason, such as a breach of customs rules or tax irregularities. Depending on the seriousness of the error, you may have to provide additional documentation, pay a fine or have your goods confiscated. However, in many cases, it is possible to recover the goods after paying the fine or correcting the errors.

To reduce tariffs and taxes, it is essential to classify and label your goods correctly in the customs tariff system. You can also explore trade agreements offering tariff reductions, such as the USMCA or CETA. What's more, working with customs brokers and optimizing your logistics processes can help you avoid unnecessary costs.

Read More

You might be interested in these articles

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

Need Help with Logistics or Sourcing ?

First, we secure the right products from the right suppliers at the right price by managing the sourcing process from start to finish. Then, we simplify your shipping experience - from pickup to final delivery - ensuring any product, anywhere, is delivered at highly competitive prices.

Fill the Form

Prefer email? Send us your inquiry, and we’ll get back to you as soon as possible.

Contact us