Introduction:

The global freight landscape has been dramatically transformed since the implementation of sweeping US tariff changes in early 2025. These policy shifts have created unprecedented disruption across shipping lanes, ports, and logistics networks worldwide. With freight rates skyrocketing by up to 40% on major routes and processing delays extending deliveries by weeks, businesses face a challenging new reality.

At DocShipper, we’ve witnessed firsthand how these tariff changes are impacting our clients’ supply chains. As freight forwarding specialists navigating this turbulence daily, we’re uniquely positioned to provide practical insights on managing the current crisis.

This comprehensive guide examines the specific US tariff changes implemented in 2025, analyzes their impact on global freight markets, and offers actionable strategies to protect your business operations during this period of adjustment.

Key Impact Snapshot:

- Container shipping rates up 40% onUS-China routes

- Customs processing times increased by 127%

- Port congestion creating 12+day vessel waiting times

- Air freight rates surged 300-350% on key routes

What Are the Key 2025 US Tariff Changes?

The recent overhaul of US tariff policies represents a fundamental shift in America’s approach to international trade. These changes have been implemented with unprecedented speed, creating significant adaptation challenges for businesses worldwide.

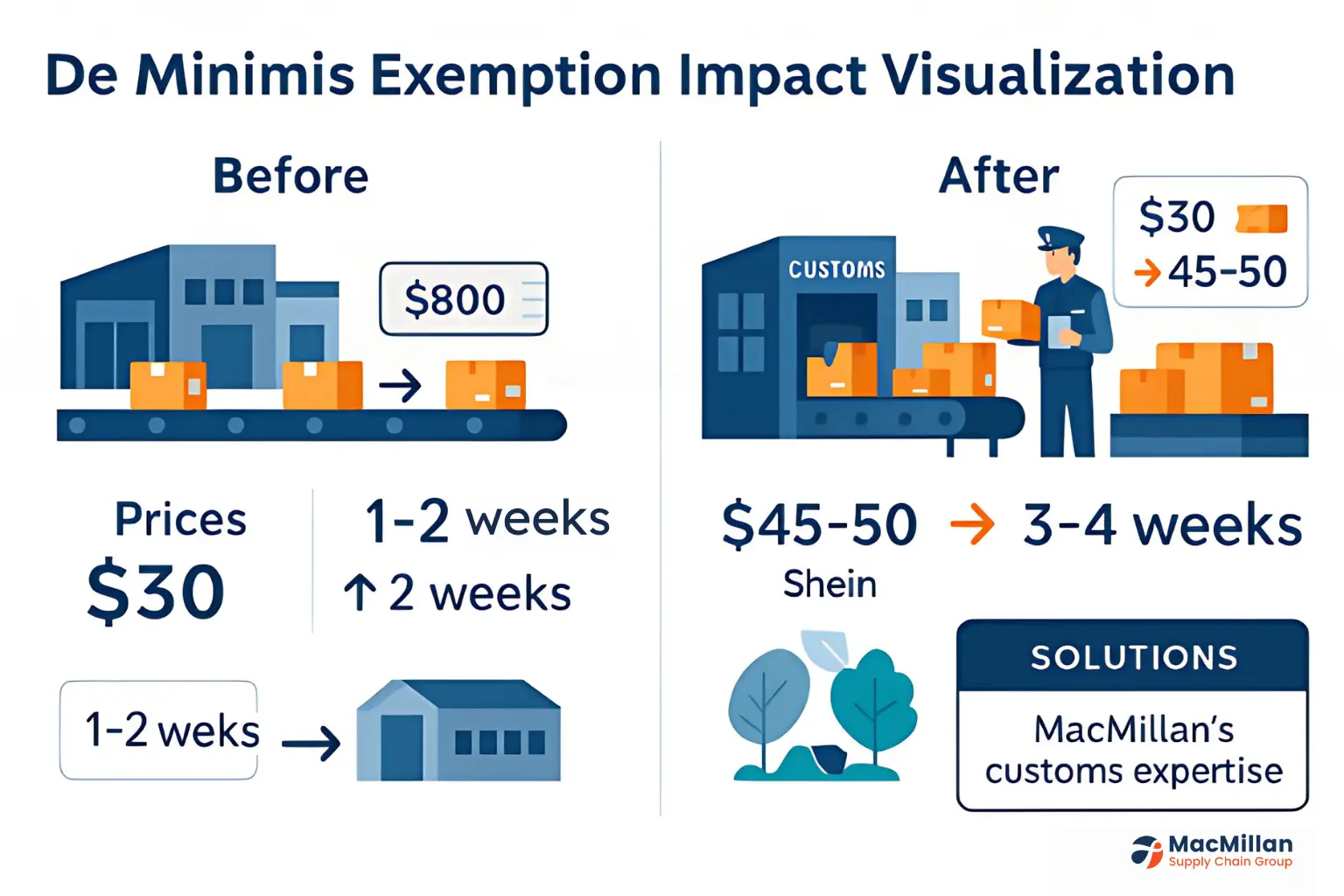

Removal of De Minimis Exemption

As of March 2025:

- Complete removal for shipments from China and Hong Kong

- Reduced to $100 threshold for all other countries

- Requires formal entry procedures for millions of previously exempt packages

This change has particularly affected e-commerce retailers and small businesses that relied on direct-to-consumer imports. Our analysis shows approximately 2.7 million small businesses now face additional costs of $15-35 per shipment in duties alone, not including the increased documentation and administrative expenses.

DocShipper Advice

We’re helping clients restructure their import strategies with consolidated bulk shipments and local warehousing solutions to minimize the impact of the de minimis removal. Contact our team for a personalized assessment.

New Tariff Rates and Trade Policies

Beyond the de minimis issue, the revised US tariff structure has introduced substantial rate increases across numerous product categories:

Product Category | Previous Average Rate | New Rate | Increase |

Chinese manufactured goods | 19.3% | 27.5% | +8.2% |

European luxury goods | 10.5% | 18.0% | +7.5% |

Aluminum and steel (most countries) | 10-15% | 25.0% | +10-15% |

Agricultural products (targeted countries) | 8-12% | 15.0% | +3-7% |

The administration has implemented these changes alongside a complex system of temporary pauses and carve-outs resulting from ongoing trade negotiations. Currently, Canada and Mexico enjoy limited exemptions, while discussions with Japan and South Korea have resulted in sector-specific tariff suspensions.

Most notably, the window for filing tariff refund claims has been reduced from 180 to 45 days, with significantly increased documentation requirements.

How US Tariffs Are Impacting Freight Markets

The implementation of new US tariff policies has triggered unprecedented turbulence across global freight markets. Let’s examine the specific impacts across different shipping modes and logistics operations.

Container Shipping Disruptions

The container shipping sector has borne the brunt of the tariff-induced chaos, with critical congestion issues emerging across major ports.

Port Congestion Statistics

- Los Angeles/Long Beach: Vessel waiting times increased from 3 – 4 days to nearly 12 days

- All major US ports: Container yards operating at 85-95% capacity (optimal is 70-75%)

- Blank sailings: Increased 165% year-over-year, reducing capacity by 1.8 million TEU

- Spot rates: China-US West Coast routes up over 200% since December 2024

This congestion creates a domino effect throughout the entire supply chain. When vessels cannot maintain schedules, containers become stranded in transit, creating artificial scarcity that further drives up rates.

European ports like Rotterdam, Hamburg, and Antwerp are experiencing similar challenges as they handle surge cargo being repositioned in response to changing trade flows.

Air Freight Market Volatility

As difficulties mount in ocean shipping, many businesses have pivoted to air freight, creating unprecedented demand for cargo space.

Current Air Freight Challenges:

- Rates increased 300-350% on Asia-North America routes since January

- Space effectively sold out weeks in advance on key routes

- Processing delays of 72-96 hours at major cargo hubs

- Unpredictable capacity due to last-minute exemption-related cancellations

Time-sensitive industries like pharmaceuticals, electronics, and fashion retail face particularly difficult decisions between absorbing massive logistics cost increases or risking market share loss due to product unavailability.

DocShipper info

Our air freight specialists are securing reliable capacity through strategic carrier partnerships and consolidated shipments. We’re helping clients maintain delivery schedules despite these unprecedented challenges. Request a consultation to discuss your urgent shipping needs.

Effects on Freight Forwarders and Carriers

Freight forwarding companies face operational challenges on multiple fronts as they adapt to the new regulatory landscape:

- Documentation burden: 35% more processing time per shipment

- Administrative costs: Emergency surcharges of $75-250 per shipment

- Operational expenses: Increased 28-32% industry-wide

- Market consolidation: Smaller forwarders struggling to adapt

This environment has created a competitive advantage for larger, technologically advanced freight forwarding operations with established customs brokerage capabilities. Companies without sophisticated compliance infrastructure face particular difficulties adapting to the new regulatory landscape.

What Shippers and Freight Forwarders Should Do

Proactive adaptation is essential for maintaining operational continuity during this period of freight market disruption. Based on our experience helping clients navigate these challenges, we recommend the following strategies:

Adjust Supply Chain Strategies

Companies importing into the US market must conduct thorough policy impact analyses to identify vulnerabilities and opportunities within their specific product categories.

Effective Supply Chain Adaptations:

- Diversify sourcing locations to countries with preferential tariff treatment

- Consolidate shipments to optimize administrative cost-per-unit

- Review product classifications to ensure appropriate tariff treatment

- Reconsider component sourcing rather than finished goods

Trade lane reconfiguration is equally important. Routes that were once optimal may now represent significant liability due to congestion, elevated rates, or heightened regulatory scrutiny. Forward-thinking organizations are implementing freight route diversification.

DocShipper Tip

One of our electronics manufacturing clients reduced their tariff exposure by 43% by shifting component sourcing to Vietnam while maintaining final assembly in their existing facilities. Learn more about our sourcing solutions. Interested in smart sourcing strategies to minimize tariffs and protect your margins? Contact us today

Enhance Communication and Visibility

Communication Best Practices:

- Schedule regular strategy reviews with your freight forwarder (weekly or bi-weekly)

- Establish direct communication channels with customs brokers

- Implement digital tracking systems that integrate with customs authorities

- Develop standardized processes for sharing shipping documentation

The value of technology implementation cannot be overstated. Companies should prioritize systems that provide real-time tracking and documentation visibility. Our clients that have implemented digital platforms integrated with customs authorities have reduced clearance delays by an average of 65%.

Build Agility and Contingency Plans

With tariff volatility emerging as a core business challenge, organizations must develop institutional agility to respond rapidly to changing conditions.

Essential Contingency Planning Elements:

- Develop scenario-based response plans for potential tariff changes

- Establish relationships with multiple suppliers across different regions

- Maintain relationships with several logistics providers

- Conduct regular supply chain stress tests (quarterly recommended)

Companies with documented contingency plans have reduced their average response time to major regulatory changes from 18 days to just 5 days—a critical advantage in the current volatile environment.

DocShipper’s Expert Analysis: Navigating 2025 US Tariffs

As specialists in international logistics and customs clearance, we’ve developed specific strategies to help businesses mitigate the impact of

the 2025 US tariff changes.

Understanding the Real Impact on Your Business

The tariff impact extends far beyond direct duty costs. Our operational data reveals the following key challenges for importers:

- Extended customs clearance: Average 127% increase in processing time

- Documentation burden: 4.3 additional supporting documents per shipment

- Compliance risk: Heightened scrutiny and enforcement of technical requirements

- Cash flow pressure: Shorter windows for duty payment and refund claims

For many businesses, these secondary effects create more significant disruption than the tariff rates themselves. We recommend conducting a comprehensive tariff impact assessment to quantify these effects on your specific operations.

Practical Strategies We’re Implementing for Client

Based on our work with hundreds of businesses affected by these tariff changes, we’ve identified several effective mitigation strategies:

- Strategic Shipment Timing and Routing

- Schedule shipments to avoid peak congestion periods

- Route through less impacted ports of entry when possible

- Utilize bonded warehousing to delay duty payment until necessary

- Documentation Optimization

- Pre-clear shipments using advance filing procedures

- Standardize classification processes across product categories

- Implement automated compliance validation systems

- Duty Recovery Programs

- Establish systematic duty drawback processes

- Identify and apply for appropriate exclusions and exemptions

- Monitor for and capitalize on temporary tariff suspensions

DocShipper info

Did you know that one of our midsize retailer, working with DocShipper, he was able implement a combination of sourcing diversification, shipment consolidation, and duty drawback programs that reduced the net impact to under $120,000—a 68% improvement. Discuss your specific situation with our experts.

Future Outlook for US Tariffs and Freight Markets

The freight market disruption shows no signs of abating in the immediate future. Businesses should prepare for continued volatility through at least Q3 2025 and Q4 2025 according to current logistics forecasts.

Expected Continuation of Volatility

Several upcoming policy developments warrant close attention:

- October 2025: Implementation of new port fees on Chinese-operated vessels

- Ongoing negotiations: Potential exemptions for specific product categories

- Retaliatory measures: Expected tariff responses from affected trading partners

Additionally, the administrative capacity of US Customs remains strained, with processing backlogs likely to persist even if policy stabilizes.

Opportunities for Innovation

Despite these challenges, forward-thinking businesses are finding opportunities to gain competitive advantage:

- Supply chain resilience investments delivering long-term operational benefits

- Technology adoption accelerating customs clearance and compliance management

- Strategic partnerships creating preferential access to limited freight capacity

Companies that view the current disruption as an opportunity to modernize their logistics operations will emerge stronger when markets eventually stabilize.

DocShipper Advice

Ready to optimize your shipping strategy? Our team is available to discuss your specific challenges and develop a customized approach to minimize the impact of US tariffs on your operations. Contact us today for a free consultation.

Conclusion:

The 2025 US tariff changes have fundamentally altered the global freight landscape. From container shipping disruptions to air freight volatility, businesses face a new reality that demands proactive adaptation.

Success in this environment requires:

- Strategic supply chain adjustments

- Enhanced visibility and communication

- Robust contingency planning

- Expert guidance on tariff compliance

At DocShipper, we’re committed to helping our clients navigate these challenges with tailored solutions that minimize disruption and control costs. Our customs clearance specialists and freight forwarding experts provide the support businesses need to transform tariff challenges into opportunities through superior execution and compliance management.

FAQ | US Tariffs Trigger Chaos in Freight Markets 2025

The key changes include higher tariff rates on Chinese manufactured goods (now 27.5%), removal of the de minimis exemption for low-value shipments from China and Hong Kong, new duties on European luxury goods (18%), and shortened windows for filing refund claims (now 45 days). These changes have contributed to significant freight market disruption, including port congestion, blank sailings, and capacity shortages.

US tariffs have severely impacted container shipping through several mechanisms:

- Pre-tariff stockpiling created sudden cargo surges

- Increased customs scrutiny slowed processing times

- Blank sailings (up 165% year-over-year) reduced available capacity

- Shipping lines repositioned vessels away from heavily-impacted routes

Major US ports now report vessel waiting times of up to 12 days, with container yards operating at 85-95% capacity (well above the optimal 70-75%).

Effective strategies include:

- Diversifying sourcing locations to countries with preferential tariff treatment

- Consolidating shipments to optimize administrative costs

- Implementing advanced tracking systems for improved visibility

- Developing formal contingency plans for tariff volatility

- Working with experienced freight forwarders who specialize in tariff compliance

Companies implementing these strategies have reduced their tariff exposure by 38-42% on average.

Yes, experts project continued disruption through at least Q3 2025. Additional factors contributing to ongoing volatility include:

- Upcoming implementation of new port fees on Chinese vessels (October 2025)

- Potential retaliatory measures from affected trading partners

- Ongoing negotiations that create uncertainty about future policy direction

Businesses should prepare for extended periods of elevated freight costs and constrained capacity while developing more resilient supply chains.

Read More

Need Help with Logistics or Sourcing ?

First, we secure the right products from the right suppliers at the right price by managing the sourcing process from start to finish. Then, we simplify your shipping experience - from pickup to final delivery - ensuring any product, anywhere, is delivered at highly competitive prices.

Fill the Form

Prefer email? Send us your inquiry, and we’ll get back to you as soon as possible.

Contact us