Back in 2022, the pandemic resulted in a record-breaking upsurge in the container shipping industry, therefore, the upcoming years are somewhat challenging given the mix of dull demand and rapid fleet expansion. This report presents a comprehensive overview of the container shipping industry’s current status and offers projections for the third quarter of 2023. We’ll look at the latest shipping market updates and tendencies affecting the container transportation industry. To successfully navigate the constantly changing container shipping market, firms, and stakeholders must have a broad understanding of these variables.

At DocShipper we understand the importance of comprehending market dynamics for shipping companies, logistics providers, and global trade participants. Our expert team offers valuable insights and strategic guidance, enabling businesses to navigate the container shipping landscape with more confidence. Partner with us to optimize operations, maximize profitability, and stay ahead in the ever-changing container shipping market.

Container shipping market volume expectations in the high and low-case scenario

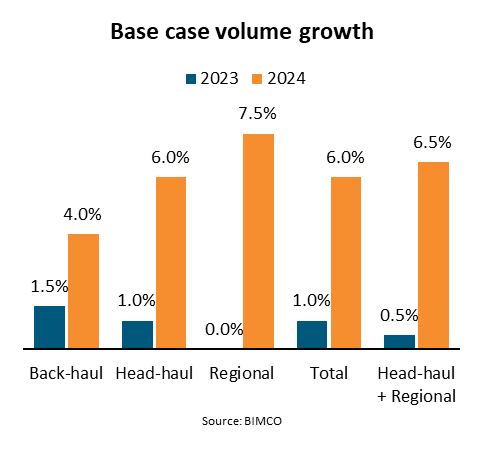

In order to predict the future trajectory of global container volumes, we have created both a base case and a low case scenario as part of our analysis of volume growth in the container shipping sector. These hypothetical situations act as prediction models for forecasting future shifts in container quantities globally during subsequent years.

Base case scenario : container volumes are expected to increase !

By the end of 2024, we assume that combined volumes for the crucial head-haul and regional trade channels will be almost 7% greater than in 2022. Three years in a row, back-haul trade routes have seen negative growth, but we foresee growth to resume in 2023 and 2024, with volumes ending the year 5.5% higher than in 2022.

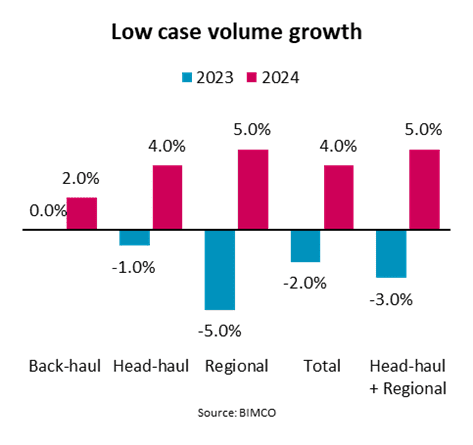

Low case scenario: global container volumes tending to drop in the next terms

By the end of 2024, compared to the base case scenario, it is anticipated that global container volumes will be 3.5% lower. More specifically, it has been projected that volumes on head-haul and regional trade routes will be about 5% lower than in the base case.

The demand for container shipping is closely linked to economic growth. The International Monetary Fund (IMF) predicts global economic growth of 2.8% in 2023 and 3.0% in 2024, which will continue to be a primary driver of container market demand.

However, there are risks that tilt toward the negative. The IMF additionally presents a worst-case scenario in which tighter financial conditions result in growth to slow to 2.5% and 2.8% in 2023 and 2024, respectively.

Advanced economies, particularly the United States, the European Union, and Japan, are projected to suffer a negative impact, with growth forecast to be 0.4 percentage points lower in 2023 than in the low case scenario. Closely connected economies, such as those in Mexico and Canada, are more likely to experience a slowdown than those with fewer ties to the United States.

DocShipper Tip

DocShipper Advice : Discover the latest market insights and successful shipping strategies in the dynamic container shipping market with the help of DocShipper. Our expertise and experience in international logistics empower businesses to navigate the complexities of the container shipping industry and seize opportunities for growth. Do not hesitate to contact us, you’ll receive a quote in less than 24H

International ports tending to stabilize : fewer strides and labor issues & backlogs

Ports all over the world are making significant strides, and issues with labor relations are generally declining. A recent agreement reached on the US West Coast has allayed the biggest worry in this regard. Additionally, port backlogs are slowly being cleared, improving schedule reliability all around.

Due to the stabilization of ports and the noticeably enhanced service quality, industry stakeholders are now focusing on advancing the digitization of port processes and modernizing infrastructure. The goal is to reduce future supply chain disruptions that might occur. As a result, it is anticipated that improved container tracking and visibility capabilities will be implemented at ports, giving stakeholders in the shipping industry more transparency and efficiency.

European shipping market showing positive development and more resilience

The global inflation rate is forecast to reach 6.9% in 2023 and moderate to 4.4% in 2024. Slower economic growth, stable commodity prices and supply chain improvements will contribute to the slower price growth. In the Euro Area, the consumer price inflation rate was confirmed at 5.5 percent in June 2023, the lowest level since January 2022, mainly due to a decline in energy prices.

One notable trend is the decline in the amount of freight relative to the available cargo space, which has reached a three-year low.

This suggests that there are still issues with the volume of cargo and the utilization of shipping capacity in the European economy. Transatlantic trade rates have historically shown resilience; however, recently, they have declined as a result of oversupply and weak demand from the United States. If this trend of declining demand and excess capacity continues, carriers will probably keep working to address the problem and find ways to rebalance supply and demand in the Transatlantic trade.

DocShipper Info

DocShipper info: The European container shipping market has faced various challenges and opportunities these last years. Factors such as Brexit, changes in trade policies, sustainability have impacted companies operating in this field. These companies need to adapt to these evolving conditions in order to stay competitive. As a reliable logistics and shipping partner, DocShipper is dedicated to helping businesses navigate these ever-changing market conditions. Contact us and get a free quote now.

Freight shipping market global trends :

In order to promote international trade and the transportation of goods around the world, the global freight shipping industry is essential.

Ocean Freight shipping : efforts to balance capacity and demand to meet shipper needs

Carriers are anticipated to keep up their efforts to reduce capacity in the upcoming months and look for ways to implement general rate increases (GRIs) and blank sailings. These actions will probably continue until container volumes consistently and significantly increase. As peak season draws near, it becomes a crucial time for carriers because it affects their profitability for the entire year. In order to balance capacity and demand, carriers typically closely monitor market developments and change their strategies as needed. Operations must be optimized and profitability must be maximized in order to meet shippers needs and maintain service reliability.

Air Freight shipping : a remaining decline for the upcoming months

The International Air Transport Association (IATA) reports that the demand for air freight is still declining compared to last year, but at a slower rate.

In comparison to other regions, North American carriers are experiencing the most difficulties, primarily because of the sharp declines in volume on two important trade routes. North America to Europe (-13.5%) and North America to Asia (-9.3%). There has been a 1.5% decrease in capacity since April 2022.

US Inland shipping trends : a continuous rise-up

The rate of inflation is currently falling in the United States, and fuel prices are at their lowest level since February 2022. Even though import container and freight volumes are on the rise relative to the pre-pandemic levels of 2019–2020, they are still below the peaks observed during the pandemic in 2021–2022.

There is little evidence to suggest that U.S. freight rates or inland volume are currently low. Aside from the customary annual build into the peak holiday shipping season this fall, there are no current freight rates or inland volumes. Shippers should keep an eye out for opportunities for rate increases from carriers, since they will undoubtedly be looking for them. Decide on their shipping tactics after doing their research.

DocShipper Info

DocShipper info : At DocShipper, we closely monitor these trends and provide customized solutions to meet our client’s changing needs. We are dedicated to offering dependable and affordable inland shipping services all over the globe. Whether it is through the optimization of transport routes, navigating regulatory requirements, or putting sustainable practices into place, our experts are here to help you from A to Z. Contact us today and let us uplift your business for greater results!

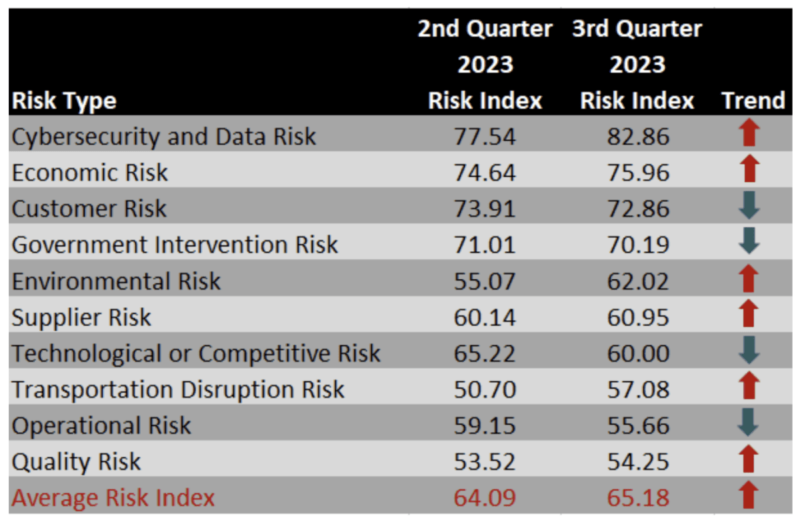

The Supply Chain Risk Index expected variations

The latest assessment reveals that cybersecurity has once again emerged as the most significant risk overall, scoring 82.86, representing a notable increase compared to the previous quarter.

This suggests that supply chain managers are growing more concerns about cyber-attacks, data theft, corruption, and system viruses as major risks in the upcoming quarters. They are also concerned about the effectiveness of security platform controls. Economic risk continues to rank as the second-biggest worry.

Advanced Technology leading the logistics industry transformation

Supply chain disruption caused by artificial intelligence is a hot topic right now. According to a Morgan Stanley report, disruptive technologies, including AI, are the newest emerging technologies that have the potential to transform. Additionally, according to the report, several hundred autonomous trucks will start operating in the US, leading to lower the cost-per-mile by 25% to 30% during 2024.

Even though it might be claimed that the industry is in a technological golden age when it comes to basic logistics activities that were once manual, there is still plenty of potential for technology to do more. The introduction of artificial intelligence and other cutting-edge breakthroughs will most likely serve as catalysts for progress.

DocShipper Advice

In order to stay ahead of all these market updates, we at DocShipper tend to follow each market update and keep our experts informed and aligned with the latest shipping markets flow or logistics industry changes! This strategic foresight helped us to assist our clients in their shipping and supply chain needs with diligence, and efficiency while helping them to gain time and money. Need to know how we proceed, contact us right now!

Container shipping market outlook : what’s coming next ?

Perspective for trade growth

Overstocking of inventories, pressure on housing markets brought on by interest rates, and pressure on consumer disposable incomes have all contributed to trade growth. The outlook for trade growth, at least for the first half of 2023, was therefore going to be quite difficult; however, during Q2 and Q3 of 2023, a lot of signs are telling that this trend is going to change.

Container shipping market capacity and congestion starting to reverse

Intense supply chain disruption and container shipping congestion have been hallmarks of the pandemic, but this is now beginning to change.

Over the pandemic’s time span, you saw a fairly significant loss of effective capacity, and that is now also starting to reverse. By the mid and last part of 2023, the container shipping market seems to have experienced an increase and a new breath after the pandemic damage.

Prediction of fleet growth by the end of 2023 and 2024

Freight rates for containers slowly declining

Spot container freight rates experienced a significant decline in the second half of 2022 and are currently significantly less expensive than the contract rates reached between shippers and shipping lines earlier in the year. Data from Xeneta shows a clear trend of contract rates beginning to decline, according to Daniel Richards, an analyst from Maritime Strategies International (MSI).

Variable impact among several fright lines revenues

Shipping companies’ primary concern in the first three quarters of 2023 is the possibility that the fall in freight rates will affect their profitability, which was still at record highs in Q3 2022.

Over the following few quarters, the effects of this decline will differ across various lines. In comparison to larger lines with a more diverse cargo base across different regions, smaller lines that concentrate more on spot business, particularly transpacific Asia to US trades, are likely to experience pressure sooner. Similar to this, lines with a higher percentage of contract cargo than spot cargo will see more consistent profits.

Around Q2 of the upcoming year, the industry as a whole, can anticipate a return to normalcy in the earnings picture. It’s crucial to remember that this normalization won’t involve a return to the razor-thin margins seen a few years prior to the pandemic. In contrast to the extremely narrow profit margins seen prior to the pandemic, the shipping industry is predicted to achieve a more balanced earnings outlook.

Conclusion

The shipping industry can expect a return to a more normal earnings picture around the middle of the upcoming year. However, it is important to note that this normalization does not imply a return to the extremely thin profit margins observed in the years leading up to the pandemic. Instead, the industry is projected to achieve a more balanced and sustainable earnings outlook. As the market continues to evolve and adapt to changing dynamics, it will be crucial for shipping companies to carefully monitor and navigate these shifts to ensure long-term profitability and success.

To navigate the constantly evolving landscape of the container shipping industry and effectively address its impact on businesses, trust the expertise of DocShipper’s professionals. Our top-notch shipping and logistics services are tailored to meet your unique needs, ensuring seamless project execution from start to finish. Contact our team today to explore how we can assist you and your business.

FAQ |Container Shipping market update & outlook for Q3 2023

The container shipping market has experienced significant growth in recent years. Despite some challenges, such as congestion and capacity issues, the market has shown resilience and continues to facilitate global trade.

Several factors shape the container shipping market outlook for Q3 2023. These include anticipated trade growth, the pace and size of fleet expansion, and the impact of congestion and capacity constraints on operations.

Container freight rates are influenced by various factors, such as supply and demand dynamics, fuel costs, and global economic conditions. While specific predictions may vary, it is important to closely monitor market trends and industry developments to gain insights into the potential trajectory of container freight rates in Q3 2023.

Businesses and stakeholders should pay attention to market trends, adapt to changing dynamics, and stay informed about trade volumes, fleet growth, and industry challenges. Understanding these factors will enable informed decision-making, strategic planning, and seizing opportunities within the container shipping industry.

Read More

You might be interested in these articles

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

- 5 Ways to Reduce Shipping Costs for Small Businesses

- What is a Freight Broker vs. Freight Forwarder[Differences, benefits and who to choose]

- Freight shipping in Russia: market updates, challenges, and opportunities in 2023

- Which Shipping Mode To Choose For Your E-commerce Business?

- What is the best way to ship freight from China?

Need Help with Logistics or Sourcing ?

First, we secure the right products from the right suppliers at the right price by managing the sourcing process from start to finish. Then, we simplify your shipping experience - from pickup to final delivery - ensuring any product, anywhere, is delivered at highly competitive prices.

Fill the Form

Prefer email? Send us your inquiry, and we’ll get back to you as soon as possible.

Contact us