Introduction

On January 29, 2026, your Chinese supplier’s factory will close its doors. For 2 to 4 weeks: no production, no shipments, no communication. For unprepared importers, it’s the beginning of a logistics catastrophe, costing thousands in lost sales. But for those who plan ahead? It’s just business as usual.

The Chinese New Year 2026 marks the Year of the Fire Horse, a celebration that will bring thousands of Chinese factories to a complete standstill. Combined with rising tariff uncertainty and freight rate volatility, this isn’t just a cultural holiday. It’s a stress test for your entire supply chain.

This comprehensive guide provides a precise timeline and actionable strategies to navigate CNY 2026 without compromising your inventory, margins, or customer satisfaction.world map with interconnected symbols of logistics

Understanding Chinese New Year 2026 and Its Impact on Global Logistics

Chinese New Year 2026, also known as the Spring Festival or Lunar New Year, falls on January 29, 2026. This date marks the beginning of the Year of the Horse according to the traditional Chinese lunisolar calendar. While the official public holiday in China lasts approximately one week (January 29 to February 4, 2026), the real supply chain disruption extends far beyond these official dates.

DocShipper info

Chinese New Year 2026 officially lasts 7 days, but most Chinese factories close for 2 to 4 weeks. Delivery times can extend by 30 to 45 days during this period.

💡 DocShipper monitors your suppliers’ calendars and alerts you to shortage risks.

Key CNY 2026 dates (January 29, 2026 – Year of the Fire Snake)

📅 Official Holiday: Chinese New Year 2026 officially begins on January 29, 2026 (Wednesday) and runs through February 4, 2026, totalling seven days of public holiday. However, the practical logistics disruption starts much earlier and lasts significantly longer.

🏭 Pre-Shutdown Period: Workers begin traveling home around mid-January 2026, causing production capacity to decline progressively. The last reliable production windows close between January 15-20, 2026, while critical shipping deadlines for pre-CNY delivery fall between January 20-25, 2026.

🔄 Recovery Period: Factories gradually reopen between February 5-15, 2026, but operate at reduced capacity. Partial production resumes throughout mid-to-late February, with most facilities returning to full operational capacity only in early March 2026. The Lantern Festival on February 12, 2026 officially marks the end of celebrations.

Typical factory closure duration (2-4 weeks)

Chinese New Year (CNY) in 2026 falls on January 29, bringing widespread factory shutdowns as millions of workers return home for family reunions. These closures typically last 2-4 weeks, but timelines vary by region, industry, and company size. This can disrupt global supply chains, so planning ahead is key. Below, we break it down into digestible sections with key insights.

Coastal Export Hubs: The Powerhouses of Trade

Cities like Shenzhen, Guangzhou, Shanghai, and Ningbo are vibrant urban centers along China‘s eastern coast, boasting world-class ports and cutting-edge infrastructure. They drive over 50% of China’s exports, boosting national GDP and linking the country to global markets in electronics, textiles, and consumer goods.

- Typical Closure: 2-3 weeks

- Early Shutdown: January 20-22, 2026

- Reopening: February 10-15, 2026

- Full Capacity: February 25-March 5, 2026

These hubs bounce back quickly due to their proximity to urban amenities and efficient logistics.

Inland Manufacturing Regions: The Heartland’s Backbone

Provinces such as Henan, Anhui, and Sichuan host vast industrial zones specializing in labor-intensive fields like automotive parts, food processing, and raw materials. They draw migrant workers from rural areas with cost advantages over coastal spots, supporting domestic supply chains while aiding economic balance, though they grapple with transport challenges and seasonal labor shifts.

- Typical Closure: 3-4 weeks

- Key Challenges: Extended shutdowns from long travel distances; higher worker turnover after holidays

- Full Capacity: March 10-20, 2026

Recovery here takes longer, often due to workers’ extended journeys and recruitment hurdles.

Large vs. Small Manufacturers: Size Matters

Large manufacturers, often backed by multinationals or the state, have strong HR strategies and perks to retain staff, ensuring smoother operations in core sectors like tech and autos. In contrast, small and medium enterprises (SMEs) are typically local or family-owned with fewer resources, making them more prone to disruptions. Component suppliers in China, vital for specialized parts, amplify delays across chains.

| Manufacturer Type | Closure Duration | Key Factors |

|---|---|---|

| Large Exporters | 2-2.5 weeks | Better staff retention; quicker restarts |

| SME Suppliers | 3-4 weeks | Higher turnover; resource constraints |

| Component Suppliers | Often longer | Cascading delays in supply chains |

Industries most affected by production shutdowns

Severely Affected Industries (3-4 week disruption)

- Electronics & Consumer Tech: High component interdependency; multiple supplier shutdowns compound delays. Example: Smartphone production (e.g., iPhone assembly) faces chip shortages, leading to 20-30% output drops and global retail stockouts.

- Textiles & Apparel: Labor-intensive; significant workforce migration impacts. Example: Fast fashion items (e.g., H&M clothing lines). China accounts for ~32% of world clothing exports. Impacts: Factory closures cause 15-25% delivery delays.

- Furniture & Home Goods:

Complex supply chains with multiple sub-suppliers. Example: Flat-pack furniture (e.g., IKEA sofas). China holds ~34% of global furniture production. Impacts: Inventory gaps, with 4-6 week backlogs.

- Toys & Seasonal Products: Peak production conflicts with CNY timing. Example: Holiday toys (e.g., LEGO sets) miss pre-Christmas rushes, with factories closing mid-peak, leading to 30-50% reduced inventory for global markets.

- Automotive Parts: Just-in-time manufacturing vulnerable to any disruption. Example: EV batteries (e.g., Tesla components). China supplies 30% of global auto parts. Impacts: Assembly halts, causing 10-20% production losses.

DocShipper Alert

Brace for extended halts in high-impact sectors like tech gadgets, clothing lines, home furnishings, festive items, and vehicle components during CNY 2026.

Proactive planning is your shield against cascading delays! Reach DocShipper for customized mitigation plans.

Moderately Affected Industries (2-3 week disruption)

- Industrial Machinery: Longer production cycles allow better planning

- Plastics & Packaging: Some automated production continues

- Building Materials: Regional variations in closure lengths

Less Affected Industries (minimal disruption)

- Chemicals & Raw Materials: Continuous process industries maintain skeleton crews

- Energy Sector: Essential services operate year-round

- Digital Services: No physical production dependency

The Real Cost of Poor CNY Planning

Failing to prepare for Chinese New Year 2026 isn’t just an inconvenience, it’s a financial disaster waiting to happen. Understanding the true costs helps justify the investment in proactive logistics planning.

Stock shortages and lost sales

The most immediate and visible cost of poor CNY 2026 supply chain planning is inventory depletion. When your products run out of stock during peak selling periods, the damage goes beyond immediate lost sales.

Financial Impact of Stockouts:

💰 Average revenue loss per stockout day: $500-$5,000 (depending on business size)

💰 Customer acquisition cost wasted: 5-10x higher than retention cost

💰 Amazon seller ranking drop: irreversible for 30-60 days after restock

💰 Market share loss to competitors: 15-25% (difficult to recover)

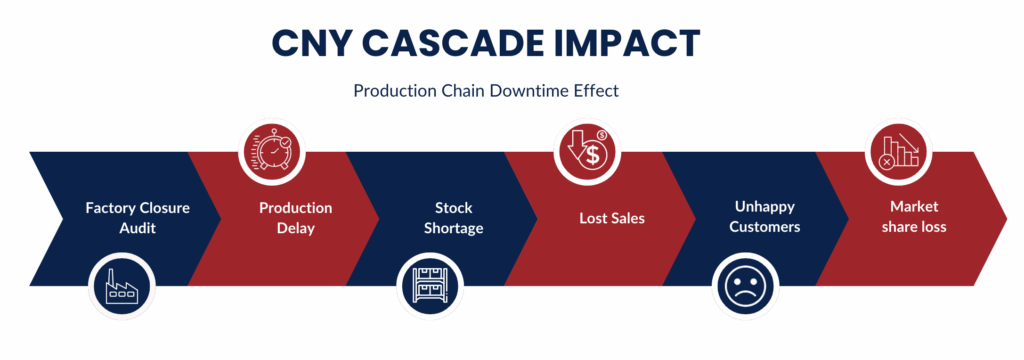

Cascading Effects of Stock Shortages:

CNY-induced shortages don’t just delay one shipment, they trigger a domino effect that compounds losses across the entire supply chain for weeks or months. These ripple effects often cost companies 2–5× more than the initial disruption itself.

- Amazon & E-commerce Rankings: Out-of-stock listings lose search visibility, taking weeks to recover even after restocking

- Customer Trust Erosion: Repeat customers switch to competitors who maintain consistent inventory

- Advertising Waste: Marketing spend during stockouts delivers zero ROI

- Retailer Relationships: B2B buyers penalize unreliable suppliers with reduced future orders

- Emergency Ordering Costs: Rush orders via air freight can cost 5-10x normal sea freight rates

Real Case: Electronics E-commerce Disaster (Lunar New Year Oversight)

VoltEdge Electronics, a mid-sized Amazon seller based in Austin, Texas, generates about $2 million in annual revenue by selling consumer gadgets and smart accessories primarily sourced from Shenzhen, China. In late 2024, the company placed its usual December restock order without realizing that the Chinese New Year (CNY) of 2025 would shut down supplier operations for several weeks. The seemingly routine procurement decision turned into a costly oversight.

Result:

- Expected delivery: Late January → Actual delivery: Mid-March

- Out of stock for: 6 weeks during peak Q1 season

- Lost sales: $180,000+

- Amazon ranking: Dropped from page 1 to page 4

- Emergency air freight cost: $35,000 for partial inventory

- Total financial impact: $215,000+

- Recovery time: 4 months to regain previous sales velocity

Additional Example:

A similar incident hit BrightWave Audio, another U.S.-based Amazon seller specializing in wireless earphones. They failed to adjust procurement before CNY 2024, resulting in a three-week stockout that cost them $95,000 in lost revenue and forced costly express shipments from Hong Kong to the U.S.

Increased freight costs (peak season surcharges)

The weeks leading to CNY 2026 shutdown create the year’s most intense shipping demand spike. Every importer tries to ship before the closure, creating severe capacity constraints and explosive freight rate increases.

Pre-CNY Freight Rate Increases:

📈 Sea freight rates: +50% to +200% (late December to mid-January)

📈 Air freight rates: +100% to +300% (peak surge weeks)

📈 Peak Season Surcharge (PSS): $500-$2,000 per container

📈 Congestion surcharges: $200-$800 per container at major ports

📈 Warehouse storage overflow fees: +30-60% standard rates

Why Freight Costs Explode During CNY Period:

Every Chinese New Year (CNY), ocean freight rates spike because demand stays high while capacity sharply contracts across the whole logistics chain. The result is a temporary but extreme supply-demand distortion, and it shows up in several very specific operational pressure points

- Vessel Space Scarcity: Container availability drops by 40-60% in peak weeks

- Port Congestion: Shanghai, Ningbo, Shenzhen experience 7-14 day delays

- Reduced Sailing Schedules: Shipping lines cut services during holiday period

- Inland Transport Bottlenecks: Truck capacity drops as drivers return home

- Equipment Imbalances: Empty container shortages at origin ports

DocShipper Alert

Sea freight bookings for pre-CNY delivery must be confirmed BEFORE December 15, 2025. After this date, peak season surcharges can surge up to +200%.

🚨 Don’t take this risk! Reserve your capacity now

Production delays and domino effect on supply chain

The CNY 2026 disruption creates a cascade of delays that extend far beyond the holiday period itself. Understanding this domino effect is crucial for accurate timeline planning.

The Multi-Stage Delay Cascade:

Stage 1: Pre-Shutdown Rush (December 2025 – Mid-January 2026)

Factories push to finalize as many shipments as possible before the break, creating an extreme peak-season effect concentrated in a few weeks. Every day counts, so speed starts to override quality and capacity discipline.

- Quality control standards slip as factories rush to complete orders

- Late-arriving raw materials cause production delays

- Packaging and labelling errors increase under time pressure

- Expedited orders take priority, pushing regular orders back

Stage 2: During Shutdown (Late January – Early February 2026)

Production stops almost entirely: factories close, engineering teams are unavailable, and operational emails simply go unanswered. Logistics and customs run skeleton staff only, just enough to move urgent cargo, but not enough to clear the backlog.

- Zero production, zero communication, zero problem-solving

- Cargo stuck at ports due to reduced customs operations

- In-transit shipments face port congestion and vessel delays

- Unable to address quality issues or specification changes

Stage 3: Post-Shutdown Recovery (Mid-February – March 2026)

Even when factories reopen, capacity doesn’t rebound instantly, return-to-work rates lag, and training cycles slow the ramp-up. Meanwhile, all previously delayed orders resurface at the same time, creating a “second wave” of congestion.

- Worker shortages: 15–30% of workforce doesn’t return

- Training period: New workers need 1–2 weeks onboarding

- Quality inconsistency: First production runs have higher defect rates

- Order backlog: 4–6 week queue for production slots

- Raw material shortages: Suppliers also recovering simultaneously

- Logistics congestion: Export bottlenecks persist for 3–4 weeks

Success Case: Textile Brand’s Strategic Diversification

Company: European fashion brand sourcing apparel from China

Strategy: Implemented 70% China + 30% Vietnam production split in 2024

For CNY 2025, they shifted 40% of January-February production to Vietnam facilities while ordering Chinese production 90 days ahead in October 2024. They built 8-week buffer stock for bestsellers, allowing Vietnam operations to continue during Chinese closures. The result? Zero stockouts during Q1 2025, $120,000 saved in emergency air freight costs, maintained customer satisfaction, and competitive advantage gained from rivals suffering stockouts. Total competitive advantage value exceeded $300,000.

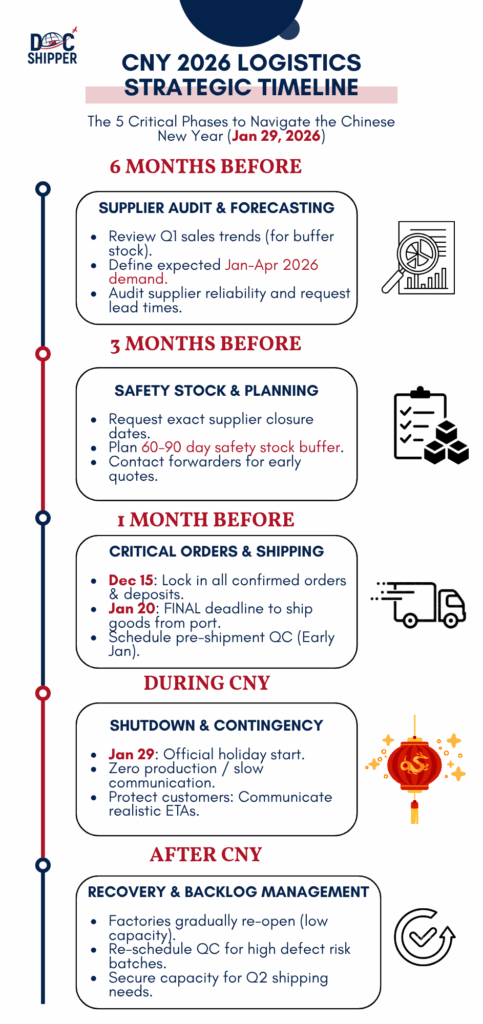

Critical Timeline: When to Order to Avoid Disruptions

Successful CNY 2026 logistics planning revolves around precise timing. This section provides a detailed countdown timeline with specific action items for each critical phase, enabling you to stay ahead of the disruption curve rather than scrambling to react.

T-90 days (November 2025): Planning and inventory forecasting

This is the strategic planning phase. You analyse Q1 2023–2025 sales to forecast Q1 2026, then build a 90-day safety stock buffer with ~30-40% extra volume to survive the CNY shutdown. You collect every supplier’s exact closure dates, focus protection on the 20% of SKUs that make 80% of revenue, and pre-identify supplier substitutes in Vietnam, Thailand, and India. Freight costs will be higher, so plan +20-30% budget and get early quotes from forwarders. You also draft a simple CNY contingency playbook with what-if responses.

DocShipper Advice

Are you prepared for Chinese New Year disruptions? Safeguard your business by asking suppliers for their closure and reopening dates, last production slots pre-holiday, and full capacity timelines. Act now to avoid raw material shortages, early order commitments may unlock production priority.

Our expert team is already helping importers maximize efficiency with early planning, consolidated shipments, and strategic warehousing. Don’t leave your Q1 supply chain to chance. Contact our team today for a proactive, customized solution.

T-60 days (December 2025): Confirmed orders and deposits

This is the commitment phase. By early-to-mid December, production slots and freight space must be locked. You issue purchase orders, pay 30-50% deposits to secure queue priority, and pre-book containers or air freight before peak surcharges take off. Quality inspections visits for early January must be booked now through third-party QC services, warehouse space reserved for buffer stock, and ERP reorder points updated. You should also inform the sales team of Q1 2026 limits. After December 15, factories are most likely fully booked, freight becomes extremely expensive, and late orders are pushed to March onwards.

DocShipper Advice

To avoid supply chain chaos during Chinese New Year, we recommend building a 90-day buffer stock, securing 2 reliable backup suppliers, and booking freight at least 60 days before closures.

Our Asia-based sourcing team negotiates directly with your factories to lock production timelines before they shut down.

T-30 days (January 2026): Final production windows

This is execution and damage-control. New orders won’t be accepted anymore, you only monitor production and avoid delays. You request daily progress photos/videos, confirm pickup dates and vessel departures, and complete pre-shipment QC in the first half of January. You finalize all export paperwork, including commercial invoices, packing lists, certificates of origin, and customs paperwork, proactively warn customers if timing slips, and prepare emergency air freight only for the most revenue-critical SKUs. If orders weren’t placed by early January, realistic delivery windows move to March/April at best.

T-15 days (mid-January 2026): Critical shipping deadlines

This is the last chance for pre-CNY departure. If goods aren’t on a vessel by Jan 20, assume post-holiday shipping even if they finish production in time. At this point you track everything daily: factory exit, port arrival, container loading, vessel departure, and customs status, because even a 1–2 day delay can add 6–8 weeks. Staffing drops, carriers cancel sailings, and paperwork errors become fatal, so you stay in constant contact with your forwarder.

If items are still being made now, plan for post-CNY arrival and update customers honestly instead of giving optimistic dates. Focus sales / marketing on what is physically in stock. Jan 20 is the hard cutoff, late cargo will simply sit until mid-February.

Post-CNY (March 2026): Gradual recovery and backlog management

Once CNY 2026 ends, production doesn’t magically return to “normal” the next morning. The real recovery begins in March 2026, with production capacities gradually stabilizing and logistics bottlenecks slowly clearing.

What to expect realistically in March:

- Factory capacity slowly rises from 40-60% (mid-February) → to 80-100% (mid-March)

- First post-CNY production lots often have higher defect ratios (+15-25%)

- Component suppliers take longer → cascading delays continue into Q2

- Booking freight in February/March remains complicated & more expensive

Critical action points during recovery (March 2026):

|

Action |

Why does it matters |

|

Reconfirm your suppliers’ workforce return rate |

prevents quality/slippage surprises |

|

Re-schedule QC inspections |

first batches after CNY are the highest risk |

|

Update ETA forecasts for customers |

maintain trust & avoid refund pressure |

|

Evaluate your safety stock performance |

refine buffer algorithm for CNY 2027 |

|

Secure capacity for Q2 |

March is where capacity becomes available again |

Logistics planning in March is not about firefighting, it’s about “resetting the supply chain baseline”.

Proactive Strategies to Secure Your Supply Chain

Build strategic buffer stock

Building a 60–90 day inventory reserve is still the most reliable shield against CNY 2026 disruption. The logic is simple: you absorb the shutdown by holding enough inventory to cover both normal turnover and delayed post-holiday replenishment.

Example : During the same 2020 CNY period compounded by COVID-19, Ron Berkes, CEO of Iron Garden Products and founder of ManufacturingChina.com, built up product reserves for his clients ahead of time. Despite facing 45-day delays in Q1, this strategy led to a 30-50% sales increase in Q2 and Q3, including for lines manufactured for Mark Cuban Companies.

Diversify suppliers and production zones

Example: Nike applied this strategy by diversifying its footwear manufacturing, increasing production in Vietnam to 50% by fiscal year 2023 (up from 33% pre-pandemic) while reducing reliance on China to 18% (down from 36%). When COVID-19 disruptions extended factory shutdowns in China in early 2020 and later zero-COVID policies caused further delays, Nike’s Vietnam operations helped maintain output and supply continuity, allowing the company to better navigate inventory shortages compared to less diversified competitors.

Negotiate with suppliers before the rush

By November 2025, most factories already know which clients they’ll prioritize. Companies that commit early deposits gain better raw material allocation, earlier production windows, and earlier QC slots.

Example: Alison Lawrence, CEO of hatmaker Wallaroo, placed several large orders with Chinese suppliers in the months leading up to CNY 2020 to prepare for peak seasons like Spring Break. This early commitment secured production slots before the holiday and subsequent COVID-19 extensions, keeping the company well-stocked on Amazon while competitors faced shortages and disruptions.

Early commitment is less about money, more about positioning.

DocShipper Alert

Lock in supplier negotiations by end-November 2025 to claim prime raw material allocations and QC slots, avoiding up to 30% production drops seen in late-rush scenarios.

Position smarter: early commitments helps you beat competitors

Ready to act? Contact DocShipper today to optimize your supply chain and secure priority positioning.

Anticipate sea and air freight rate peaks

Freight pricing during CNY behaves like an auction curve: predictable, brutal, and unforgiving. Importers who booked ocean freight early paid lower rates, such as around $1,500 per FEU, while those who waited until closer to the holiday were quoted up to 16-30% more, sometimes with no guarantee of space. Air freight becomes even more chaotic: the week before can hit +10-60% premiums. This happens every CNY season. The only defense is booking capacity early and locking priority slots before the spike wave begins.

Example: In the lead-up to CNY 2018, ocean freight rates on the Far East to North Europe route increased 16.1% from $1,487 per FEU on December 1, 2017, to $1,726 per FEU on February 16, 2018. Shippers who secured bookings early in December locked in the lower rates and avoided space shortages during the pre-holiday rush, while those delaying faced higher quotes and market volatility post-holiday.

Chinese New Year 2026 + Tariffs: The Double Impact

The intersection of CNY 2026 and U.S. tariff uncertainty creates a double shock for importers, making early planning and proactive front-loading essential to avoid compounding delays and skyrocketing costs.

Trump tariff uncertainty 2025-2026

The U.S. tariff debate for 2025–2026 adds another layer of unpredictability to China’s freights. Electronics, automotive parts, EV components, solar-related imports, all categories exposed to China tariffs, could be impacted by sudden rate adjustments just weeks before CNY 2026. This means importers are not only rushing to beat factory closures; they are simultaneously trying to beat potential tariff hikes. Two panic cycles, overlapping.

How tariffs amplify CNY disruptions

Tariff risk doesn’t replace CNY disruption, it amplifies it. Importers simultaneously front-load inventory for tariff avoidance and pre-CNY safety stock. The result is a demand tsunami for freight and production in Q4 2025 logistics year, which accelerates the surge in spot pricing, squeezes container availability, and deepens congestion at Chinese ports. The cost curve becomes exponential: every week of delay increases freight rates, production lead times, and working capital exposure.

Preventive import strategies (front-loading)

The only rational counter-strategy is aggressive front-loading between October and early December 2025. This means placing deposits early, locking freight rates early, and building buffer inventory early, even if it temporarily increases warehousing costs. Companies who front-load will sit on comfortable stock while competitors are stuck with empty shelves and $9,500 containers. CNY + tariffs is not a “normal” disruption pattern, it is a double shock. The winners of Q1 2026 will be the ones that act in Q4 2025, not the ones who negotiate excuses in January.

Complete Checklist: Your CNY 2026 Action Plan

To navigate CNY 2026 without disruption, a step-by-step, time-bound action plan ensures every critical task, from supplier audits to post-holiday recovery, is executed on schedule.

6 months before (August 2025): Supplier audit and forecasting

Six months before Chinese New Year 2026, the priority is not ordering, it is visibility. In August, your focus shifts to reviewing sales trends from previous Q1 cycles, defining expected demand curves for January–April 2026, and refreshing your ABC segmentation to identify your “revenue critical SKUs”. At the same time, you audit supplier reliability: you request updated lead times, ask for forecasted closure plans, and check whether key sub-suppliers (components, packaging, tooling) have exposure to inland provinces where factory closures last longer. This is the strategy month. Forecasting quality now determines how much panic you will, or won’t, have in January.

3 months before (November 2025): Orders and freight bookings

November is where planning becomes commitment. To remain in control, you convert forecasts into firm purchase orders, and you secure production slots before everyone else starts competing for capacity. In this phase, companies who pay deposits early get priority when the factory schedules production. You also begin reserving ocean freight space before spot rates accelerate. This is the month when your logistics planning becomes tangible: freight booked, production timelines confirmed, QC slots penciled in. Missing this window forces you into a reactive mode, and reaction is always expensive in December.

1 month before (December 2025): Confirmations and production tracking

December is pure execution. This is where you stop planning and start verifying. You follow up with suppliers weekly (if not daily), ensuring that raw materials have arrived, production lines are active, and packaging isn’t delayed. QC inspections must be pre-scheduled for early January, not last minute. Logistics files must be clean and complete, because one missing certificate can freeze a container at departure. Companies who are well organized in December enter January in “monitoring mode”. Those who are disorganized become hostages to their supplier’s silence.

During CNY (January-February 2026): Communication and contingencies

Once shutdown begins, production stops and communication slows dramatically. During this period, the smartest operators do not chase factories, they protect their customers. This is the moment to communicate realistic ETAs, adjust sales campaigns, and re-allocate stock toward the highest ROI channels. If you have emergency air freight options, this is where you deploy them for critical SKUs only. And if you diversified, Vietnam, India, Mexico, this is where that decision pays off. Supply chain leadership during CNY is measured not by “control”, but by your ability to preserve customer trust.

After CNY (March 2026): Recovery and adjustments

When factories reopen, your priority is not to push for speed, it is to restore stability. March is the month where workers return, defects spike, and capacity ramps up gradually. You must re-validate lead times, confirm raw material availability, and conduct early QC on every new batch. This is also the perfect moment to measure the efficiency of your buffer stock strategy and refine your 2026 playbook. Winners don’t “restart” in March, they exit March stronger, because they use the recovery phase as an operational reset.

Tools and Partners to Navigate CNY 2026

To navigate CNY 2026 effectively, importers need the right mix of digital tools and expert partners to turn potential disruption into predictable, manageable operations.

Supplier tracking platforms (closure calendars)

Real-time supply chain visibility solutions

Real-time visibility tools solve a different problem: not when factories close, but where your container physically is.

In Q1 2026, delays aren’t just upstream at the factory, they happen in:

- ports

- transship hubs

- customs inspections

- final-mile trucking

Visibility platforms allow importers to anticipate late arrivals before customers feel the pain. A late container is manageable if communicated early. When you combine this with your forecasting logic, you move from reacting to predicting, which is where margin protection happens.

The role of an expert freight forwarder like DocShipper

A seasoned freight forwarder is not just “a service provider”, it is your risk interpreter. DocShipper’s strength during CNY 2026 is the ability to translate chaos (rate surges, capacity shortages, routing changes) into concrete options, timelines, and cost simulations.

This matters because during CNY, speed of decision-making is more valuable than price negotiation. The real value of a partner like DocShipper is not securing a container, it is helping you avoid the containers you shouldn’t book.

DocShipper info

While your competitors suffer Chinese New Year disruptions, you stay calm. With DocShipper:

✓ Custom logistics planning

✓ Real-time supplier tracking

✓ Buffer stock in our warehouses

✓ Secured freight at best rates

Prepare for CNY 2026 now. Entrust us with all your logistics and supply chain projects, and we’ll make sure everything runs smoothly. Get in touch with our experts!

2026 Perspectives and Emerging Trends

As CNY 2026 approaches, the landscape of global manufacturing is evolving. Businesses can no longer rely solely on historical patterns, new trends in closure durations, automation, and alternative sourcing are reshaping the rules of engagement. Understanding these shifts is crucial: what worked in previous years may no longer be enough to maintain continuity, optimize costs, and protect margins. The following insights highlight the emerging dynamics importers should consider staying ahead of disruptions.

Evolution of closure durations (gradual shortening)

There is a slow structural shift: closures are shortening, but the recovery ramp after reopening is still volatile. Some coastal provinces may operate with fewer days offline in 2026 thanks to larger migrant worker retention rates. But the real bottleneck is not the “closure week count”, it is the 2–4 week stabilization that follows. So even if CNY 2026 is shorter on paper, the business logic of stocking early barely changes.

Automation and reduced human impact

Alternative sourcing: Vietnam, India, Mexico as backup plans

Near-China alternative sourcing hubs in Vietnam, India, Mexico, are transitioning from “risk mitigation” to “strategic continuity platforms”. The best importers will architect hybrid networks: keep China for cost optimization, shift certain SKUs to Vietnam for continuity, and route North American demand through Mexico to bypass ocean freight pressure altogether. Alternative sourcing is no longer a moral stance, it is a structural necessity when CNY 2026 and tariffs collide.

Conclusion

Chinese New Year is no longer a seasonal inconvenience, it is a predictable annual stress test. The brands who treat it as an “exception” will continue to bleed margin every February. The ones who treat it as a strategic scenario, and prepare like they would for a financial quarter, will convert disruption into market share. CNY 2026 is not a surprise. It’s an opportunity for those who move early.

DocShipper’s operational value is not visible in calm periods, it is visible during uncertainty. The team anticipates rate peaks, books capacity early, screens alternative routing, and safeguards timelines before shocks even materialize. For importers, this means clarity, control, and peace of mind during the loudest season of the year. In a world where lead times feel unstable and rates feel random, DocShipper is the partner that brings structure back into Q1 2026.

FAQ | Chinese New Year 2026: Logistics Planning Timeline

Factory closure dates vary by region, industry, and company size. Coastal export hubs often reopen faster than inland regions, and SMEs may extend closures. The most reliable way to track this is through digital supplier tracking platforms and closure calendars, which consolidate real-time updates and expected workforce return rates. DocShipper can integrate this information and alert you to risks, so you can adjust procurement and shipping schedules proactively.

Yes. Alternative sourcing reduces risk but does not eliminate the need for a strategic 60–90 day inventory reserve. Buffer stock ensures continuity during transport delays, QC inspections, or production hiccups, even outside China. Combining hybrid sourcing with buffer inventory is the most resilient approach to avoid stockouts during CNY 2026.

U.S. tariff uncertainty can compound CNY disruptions. Importers often face a double surge: front-loading stock for tariff avoidance and pre-CNY safety stock. This can dramatically increase freight costs and strain container availability. Acting early (October–December 2025) to place orders and lock freight capacity is critical to mitigating both risks.

Partially. Tier-1 suppliers with higher automation can maintain smoother operations during CNY, but tier-2 and tier-3 suppliers still rely heavily on manual labor. The most effective leverage comes from data-driven planning, predictive ETAs, and automated scheduling rather than relying solely on robotics.

Read More

Looking for more? These articles might interest you:

Need Help with Logistics or Sourcing ?

First, we secure the right products from the right suppliers at the right price by managing the sourcing process from start to finish. Then, we simplify your shipping experience - from pickup to final delivery - ensuring any product, anywhere, is delivered at highly competitive prices.

Fill the Form

Prefer email? Send us your inquiry, and we’ll get back to you as soon as possible.

Contact us